Article content

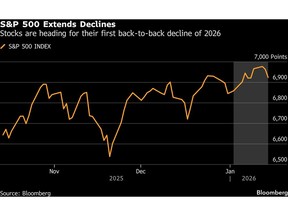

(Bloomberg) — A slide in US stocks continued Wednesday as a flurry of economic data failed to change any expectations for the Federal Reserve’s interest-rate path and traders digest the latest round of big bank earnings.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The S&P 500 Index fell 0.7% at 9:58 a.m. in New York, extending declines for a second-straight day and putting the benchmark on track for its first back-to-back decline of the year. The tech-heavy Nasdaq 100 Index dropped 1%, also adding to losses from Tuesday’s session.

Article content

Article content

Article content

Wholesale inflation picked up slightly in November from a month earlier, driven by a jump in energy costs. The producer price index rose 0.2% after climbing 0.1% in the prior month, according to the Bureau of Labor Statistics.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

While the data was stronger than expected, it “likely doesn’t change anything for the Federal Reserve,” said Clark Bellin, president and chief investment officer at Bellwether Wealth. “We expect the Federal Reserve to remain on hold for the next six months and then cut rates by one or two times in the second half of 2026.”

Article content

Meanwhile, retail sales in November rose more than forecast, fueled by a rebound in car buying and holiday sales. The value of retail purchases, not adjusted for inflation, increased 0.6% after a downwardly revised 0.1% drop in October, Commerce Department data showed Wednesday.

Article content

Geopolitics weighed on traders’ minds as the unrest in Iran continued. Oil has reached the highest level since October as the market awaited the US response to the situation. President Donald Trump has been ratcheting up military threats, while Reuters reported some personnel have been advised to leave the US air base in Qatar.

Article content

Article content

Bank Earnings Are Key

Article content

Big bank earnings continued to roll in. Citigroup Inc. advanced after reporting a surge in financial advisory fees, capping off a year where revenue from handling mergers rose to an all-time record, counter to the relatively sluggish growth reported by JPMorgan Chase & Co. a day earlier.

Article content

Despite Bank of America Corp.’s equity traders posting their best quarter ever, shares in the lender declined. Meanwhile, Wells Fargo & Co. fell after reporting net interest income and revenue that were slightly below consensus estimates.

Article content

Expectations for earnings season are “very high,” according to Miller Tabak’s Matt Maley, adding that is one of the key reasons for Wall Street’s bullish view on 2026.

Article content

“If the earnings/guidance merely meets expectations over the coming weeks and does not create a wave of earnings estimate increases, it could create some problems for the stock market,” Maley said.

Article content

.jpg) 1 hour ago

3

1 hour ago

3

English (US)

English (US)