Article content

(Bloomberg) — US equity futures dropped on Friday as President Donald Trump weighs whether to back Israel militarily in its conflict with Iran.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Contracts for the S&P 500 fell 0.4% in early Asia hours after slipping 0.9% Thursday in thin US trading during the Juneteenth holiday. Futures for equity indexes in Japan, Australia and Hong Kong all pointed to small declines at the open.

Article content

Article content

Article content

The downbeat mood reflects unease over the prospect the US may be pulled into another war in the Middle East, after the White House said Trump will decide within two weeks whether to strike Iran. The remarks offered some short-term clarity but did little to resolve broader uncertainty around potential US involvement and the risk of renewed energy-driven inflation.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“If the US does strike, you’re going to see a big knee-jerk reaction,” said Neil Wilson, investor strategist at Saxo UK. “No one will be wanting to make big long bets.”

Article content

West Texas Intermediate edged lower early Friday after rising 0.9% Thursday, in a week where market reaction to the Middle East conflict has been most concentrated in oil. The dollar was little-changed against a basket of currencies Thursday after paring earlier gains.

Article content

Traders’ sentiment turned more cautious following a Bloomberg report that senior US officials are preparing for a possible strike on Iran in the coming days. Markets were already on edge after the Federal Reserve downgraded its estimates for growth this year and projected higher inflation.

Article content

Article content

Israel struck more of Iran’s nuclear sites on Thursday and warned its attacks could bring down Tehran’s leadership as both sides awaited a decision from Trump on whether to join the offensive.

Article content

Some extreme scenarios resulting from increased US involvement in the Israel-Iran war could push oil prices as high as $130 to $150 a barrel, particularly if Iran retaliates in a major way, said Jennifer McKeown, chief global economist at Capital Economics Ltd. Such a development would pause further policy easing by central banks, she said.

Article content

“Even though central banks would like to think that would be a temporary impact, I think it would be a brave central bank that would cut interest rates,” McKeown told Bloomberg TV.

Article content

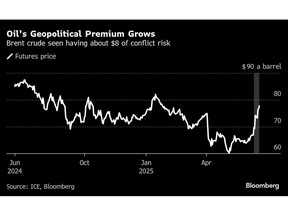

Brent futures have been pricing in a geopolitical premium of about $8 a barrel since Israel and Iran began attacking each other last week, according to a survey of analysts and traders. US intervention in the conflict would bolster that further, but exactly how much would depend on the nature of the involvement, the nine respondents said.

Article content

In Thailand, the political fate of Prime Minister Paetongtarn Shinawatra remained uncertain after mounting opposition calls and street protests for her to resign following a leaked phone call in which she criticized her army.

.jpg) 7 hours ago

1

7 hours ago

1

English (US)

English (US)