Article content

(Bloomberg) — An investment firm for Brian Souter, who built one of the world’s biggest transport fortunes, plans to keep striking deals even as other money managers curb risk-taking amid heightened volatility in global markets.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The Stagecoach co-founder’s namesake family office is staying alert to new investments in private equity, where it’s carved out a niche allocating to companies below the radar of buyout giants such as Blackstone Inc., according to the Scottish tycoon. The Edinburgh-based firm co-invested last month with Horizon Capital in acquiring a majority stake in consulting firm ERA Group for an undisclosed sum, and it’s already lining up further deals.

Article content

Article content

Article content

“Our principle is to invest right through the cycle,“ Souter, 71, whose family office oversees about £388 million ($529 million) in net assets, said in a recent interview. ”We don’t dip in and dip out.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Private investment firms for the world’s rich are increasingly a force to reckon with in global business, pushing into markets for buyouts, second-hand private equity and even taking activist positions in listed companies. Usually serving a single or small group of clients, they’re often able to be more nimble than many institutional firms.

Article content

That flexibility becomes more valuable amid a geopolitical and macroeconomic environment that seems to shift by the day, with President Donald Trump‘s tariff plans creating uncertainty and spreading Middle East conflicts roiling oil prices. More than half of 175 family offices surveyed this year by BlackRock Inc. cited the current geopolitical landscape as increasingly critical to their allocation decisions.

Article content

“We could see this potentially bringing some opportunities for us,” said Calum Cusiter, a Souter Investments managing director. “It’s just about the risk antenna being a bit more alert.”

Article content

Article content

Souter, a former Arthur Andersen accountant, founded Stagecoach with his sister in 1980 as Margaret Thatcher’s Conservative government began to deregulate the UK’s bus industry. He expanded the business through acquiring rivals while maintaining a focus on affordable fares, turning it into Britain’s biggest bus operator and a member of the nation’s benchmark FTSE 100 Index.

Article content

He was still serving as Stagecoach’s chief executive officer when he established Souter Investments almost two decades ago, with the transport company making up the bulk of his wealth.

Article content

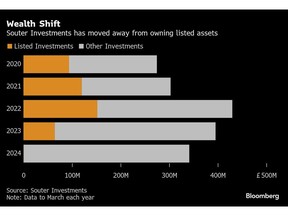

It has since struck more than 50 deals and sought to preserve Souter’s fortune by diversifying into sectors such as financial services, energy and health care, reducing Stagecoach’s concentration to about 16% of total assets by early 2022.

Article content

Later that year, Deutsche Bank AG’s DWS Infrastructure completed an all-cash takeover of the bus operator, handing Souter and his 82-year-old sister Ann Gloag a total of about £120 million between them. Roughly £25 million from the deal separately went to Souter’s namesake foundation, which oversees more than £100 million of investments and receives funding through his family office, filings show.

.jpg) 6 hours ago

1

6 hours ago

1

English (US)

English (US)