Article content

There are many reasons to doubt the rebound in United States stocks, but it has at least one powerful factor on its side: momentum.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

History shows that the rally may extend further than investors might expect and bode well for stock performance down the road. Though it’s not infallible, that trend is good news for traders betting that stocks might have more room to run following a dismal start to the year.

Article content

Article content

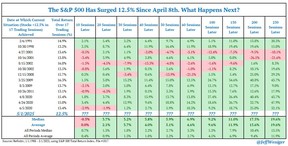

The bounce in the S&P 500 index has already been one for the record books. The benchmark index notched its ninth-straight daily gain on Friday, the longest stretch since 2004. Such streaks have tended to precede further upside: The S&P 500 was a median 20 per cent higher a year after moves of similar magnitude while notching gains in shorter-term periods along the way, according to WisdomTree’s Jeff Weniger, who analyzed data going back to the late 1980s.

Article content

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“Your gut says ‘Maybe this is too much, maybe take some chips off the table,’” said Weniger, the firm’s head of equities. “But in actuality, this often times tends to beget more in the way of the rally.”

Article content

Article content

Analysts have pointed to a variety of factors driving the gains. Markets have cheered signs that the U.S. is seeking to eventually ease tariffs on China and reach trade deals with other countries. Stronger-than-expected jobs data on Friday also buoyed optimism, along with solid earnings from a quartet of Big Tech companies last week.

Article content

Market observers also say that fund managers are fearful of missing out on more upside and some are now raising their exposure to equities, further stoking the upward momentum. The S&P 500 has rebounded from a loss of nearly 20 per cent last month.

Article content

Article content

Technical analysts have also noted that the benchmark is back above its 50-day moving average, a closely-watched indicator of short-term support, for the first time since the week it hit its last record.

Article content

Article content

Another important factor is the reawakening of the so-called Magnificent Seven technology giants, whose shares are key drivers of the S&P 500 due to their heavy weightings in the index. Earnings for Meta Platforms Inc. and Microsoft Corp. were stronger than expected last week, allowing investors to shrug off less favourable results from Apple Inc. and Amazon.com Inc. A Bloomberg index of Magnificent Seven stocks has surged about 19 per cent since the April 8 bottom.

Article content

Article content

The cohort “may be the only growth story in town and now they’re trading at valuations I would say are cheap,” said David Wagner, portfolio manager at Aptus Capital Advisors LLC.

Article content

Plenty of investors are hesitant to jump aboard the rally, especially with little clarity on how the trade war could shake out and its eventual toll on the economy. Actual progress on negotiations with China remains remains scant. Trade frictions with other countries could also flare once the pause on levies expires in July.

.jpg) 4 hours ago

1

4 hours ago

1

English (US)

English (US)