Article content

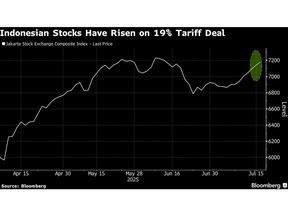

(Bloomberg) — Financial markets greeted US President Donald Trump’s tariff deal with Indonesia with little fanfare Wednesday, signaling the rate of around 20% that was once viewed as punitive is now seen as workable.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Stocks and other assets were mixed in Asia after Trump announced a 19% tariff for Indonesian goods. Shares in the southeast Asian nation ticked higher on optimism the new levy was at least lower than the 32% originally threatened by the president. Vietnam’s shares have risen since Trump in early July said he reached a trade deal with the nation.

Article content

Article content

Article content

The recent calm is a turnaround from earlier in the year. The market collapse, including havens such as Treasuries, was so severe in April after Trump’s global “Liberation Day” tariffs that he paused them within days.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Now, markets view them more as bargaining ploys used by the president to extract trade concessions. A number of measures of financial-market volatility, such as the ICE BofA MOVE Index of US Treasuries, have touched multi-year lows.

Article content

While countries such as India and Vietnam have attempted to negotiate US tariffs of well below 20%, Trump has said he’s eyeing blanket tariffs of 15% to 20% on most trading partners. This suggests the 20% level is no longer perceived as a penalty but rather as a standard in the negotiations.

Article content

“Indonesia’s apparent deal with Trump, alongside the UK-US deal and the Vietnam-US deal, point to the US tariffs staying in the 10%-to-20% range,” said Homin Lee, a macro strategist at Lombard Odier in Singapore. There’s some relief in Asia, but investors are largely in a wait-and-see mode as tariffs for the European Union, Mexico and Canada, which together represent half of US imports, are still in the works, he said.

Article content

Article content

The US-Indonesia agreement — which hasn’t yet been confirmed by Jakarta — would be the first struck with a country targeted by Trump’s tariff letters dispatched last week. The correspondence was seen as attempt to ratchet up pressure on negotiators before the Aug. 1 deadline for the higher duties to come into effect.

Article content

“So far, equity markets have reacted calmly as the reduction of uncertainty has been viewed positively,” said Rajeev De Mello, a portfolio manager at Gama Asset Management SA. Still, “20% US tariff levels are a worrying evolution, which would lead to a higher effective US tariff than what was expected a few weeks ago,” he said

Article content

Some analysts see the latest agreement as beneficial to wider Asian assets.

Article content

The US deal with Indonesia will “help ease uncertainty on the trade front,” Audrey Goh, head of asset allocation at Standard Chartered Wealth Management Group in Singapore, said in a Bloomberg Television interview. “More trade deals being inked between the US and Asian partners, should help to ease and bring down marginal uncertainty and will help the likes of Asia ex Japan to outperform.”

.jpg) 15 hours ago

1

15 hours ago

1

English (US)

English (US)