Article content

(Bloomberg) — It was, according to Daniel Chu, “the stupidest f—-ing thing [he had] ever heard.”

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

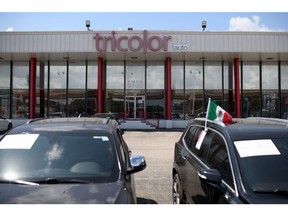

That’s how the Tricolor Holdings founder, in a secretly recorded August phone call, described the blunder that ultimately exposed what authorities allege was a more than $1 billion fraud.

Article content

Article content

Ameryn Seibold, one of Chu’s top lieutenants, was tasked with manipulating the Excel data that the subprime auto lender regularly sent to its financiers, making thousands of delinquent car loans appear current. But in another column listing the loans’ outstanding balances, Seibold failed to reduce the numbers, leaving a glaring mismatch, according to federal charges unsealed Wednesday.

Article content

Article content

How could Seibold “be doing this and not thinking that the balance has to reduce,” Chu said.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Seibold’s explanation only underscored the extent of the mess. He said he had been carrying roughly 8,000 charged-off loans across multiple financing facilities for “a long time,” and couldn’t shrink them all at once without forcing the already deeply troubled company to book millions of dollars in repayments, according to the indictment. “I’m doing what I thought was what we needed,” he said.

Article content

The discrepancy was ultimately flagged not by regulators or auditors, but by a junior analyst at Waterfall Asset Management, one of Tricolor’s lenders, Bloomberg previously reported, setting off its spiral into bankruptcy just weeks later.

Article content

The 20-page indictment lays out a fraud vast in scope but shockingly crude in its execution, relying on little more than doctored spreadsheets and the hope that no one would look too closely. That the deception lasted as long as it did — prosecutors allege it began around 2018 — and fooled some of the US’s biggest lenders has turned the collapse into one of the cautionary tales circulating on Wall Street lately.

Article content

Article content

“It’s astonishing that this allegedly went on for years and only came to light because someone made a dumb mistake,” said Avinand Jutagir, a portfolio manager at Curasset Capital Management. “People may not realize it, but tens of billions of dollars worth of bonds can rely on plain old Excel files.”

Article content

Chu, reached via text, declined to comment. So did an attorney for Seibold, who pleaded guilty to fraud in a separate indictment. Waterfall and other Tricolor creditors, including JPMorgan Chase & Co., Barclays Plc and Fifth Third Bancorp also declined to comment.

Article content

From the moment Tricolor’s lenders flagged the data discrepancies, the crisis set off a flurry of high-stakes calls among the company’s top executives. Some were secretly recorded by one and sometimes multiple participants, capturing a mix of panic, finger-pointing, and frantic strategizing as the scope of the problem came into focus.

Article content

By late August, Chu was plotting with other Tricolor executives, including David Goodgame and Jerome Kollar, on how to settle with JPMorgan, which had already pulled its lending facility, according to the charging document. During the call, Chu likened Tricolor’s meltdown to Enron, the energy giant felled by accounting fraud. He even discussed the idea of pinning the blame on banks for allegedly ignoring red flags, a threat they hoped to wield as leverage.

.jpg) 8 hours ago

3

8 hours ago

3

English (US)

English (US)