Article content

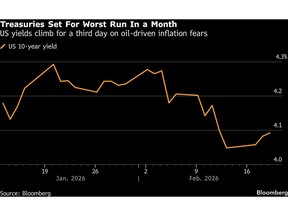

(Bloomberg) — Treasuries are on course for their longest losing streak in a month as growing tensions between the US and Iran fuel oil-driven inflation fears.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

US 10-year yields rose for a third day, up one basis points to 4.09%. Oil prices climbed Thursday to build on the previous day’s surge, following a report that American military intervention in Iran could come sooner than expected.

Article content

Article content

Article content

“A prolonged, US‑led operation aimed at regime change would likely have a far larger and more persistent impact on energy markets, challenging the disinflation narrative and pushing curves to potentially reassess medium‑term inflation risk,” said Evelyne Gomez-Liechti, a strategist at Mizuho International Plc.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Inflation concerns are already at the forefront of investors’ minds after minutes of the Federal Reserve’s Jan. 27-28 policy meeting revealed several officials suggested the central bank may need to raise interest rates if price growth remains stubbornly high.

Article content

Investors will also be focused on weekly US jobs numbers due Thursday, to corroborate the views revealed in the minutes showing the vast majority of participants judged that downside risks to employment had moderated in recent months.

Article content

Economists surveyed by Bloomberg forecast initial jobless claims rose 225,000 in the week ending Feb. 14, slightly down from the prior 227,000.

Article content

Money markets have shaved wagers on Fed rate cuts this week, assigning around a 25% chance of a third reduction this year, down from 50% on Friday. The monetary-policy sensitive two-year Treasury yield rose to 3.47%.

Article content

The US will sell $9 billion of new 30-year Treasury Inflation-Protected Securities later in the day. Fed speakers include Michelle Bowman and Neel Kashkari, who are both voters.

Article content

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)