Article content

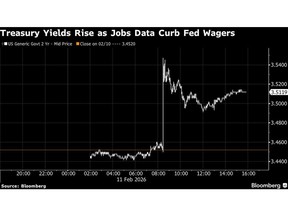

(Bloomberg) — A surprise surge in US jobs hit Treasuries as traders pared bets on interest-rate cuts by the Federal Reserve this year. Asian equity futures were mixed after US stocks ended flat.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The latest monthly US employment report showed 130,000 roles added in January, twice the median forecast, underscoring a robust economy that may not merit imminent policy easing.

Article content

Article content

Article content

Short-dated Treasuries were hit the hardest, with two-year yields rising six basis points to around 3.51%. Money markets priced in the Fed’s next cut in July, from June previously. Gold and silver edged lower on Thursday after gaining in the previous session while Bitcoin fell for a fourth session. The dollar was fractionally weaker on Wednesday, benefiting the yen, which touched a two-week high.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Equity-index futures pointed to gains in Japan as markets were set to reopen Thursday following a holiday, while contracts for Hong Kong fell. Australian shares opened higher. The S&P 500 ended Wednesday flat after a bumpy session with real estate services stocks getting hit, while the Nasdaq 100 rose 0.3%.

Article content

The moves signaled that for now, strength in the US economy counterbalances the desire for lower borrowing costs, supporting risk sentiment that has itself taken a battering over AI concerns in recent weeks. The next key hurdle for markets is Friday’s US inflation report, which could reinforce the case for keeping rates higher for longer if price pressures fail to ease.

Article content

Article content

“The report will ease concerns around the consumer,” wrote Krishna Guha at Evercore, referring to US jobs data. “It pours cold water on the idea the Fed could cut rates again before mid-year and will fuel internal debate as to how restrictive policy is and how much slack there is in the labor market.”

Article content

The S&P 500 closed near 6,940. In late hours, Cisco Systems Inc. gave a tepid margin forecast, overshadowing a generally positive outlook fueled by artificial-intelligence gains. McDonald’s Corp.’s US sales grew at the fastest pace in more than two years.

Article content

In commodities, oil rose as tensions in the Middle East outweighed concerns that there’s a supply glut growing. Nickel extended gains after Indonesia signaled a sharp cut to output this year, curbing supply from the world’s biggest mine.

Article content

Concerns about rising unemployment that led to three rate cuts late in 2025 — before a pause in January — were likely eased by Wednesday’s data. At last month’s policy meeting, Fed officials had already cited signs of stabilization as a reason to hold rates steady.

Article content

US payrolls rose in January by the most in more than a year and the unemployment rate unexpectedly fell, suggesting the labor market continued to stabilize.

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)