Article content

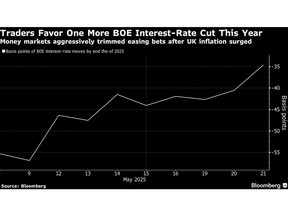

(Bloomberg) — Traders pared bets on further interest-rate cuts from the Bank of England, sending the pound to a three-year high versus the dollar, after data showed UK inflation rose more than expected in April.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

Money markets favor a terminal interest rate of 4% for the first time since early April, which means just one more quarter-point cut this year instead of two. Swaps also imply just a 40% chance of a reduction in August, from 60% before the data.

Article content

Article content

Expectation the BOE will be even more careful in lowering interest rates boosted the pound, which was already trading near its highest level this year. Sterling rose as much as 0.8% to $1.3469, the strongest since February 2022, and for the first time since the global financial crisis, options traders are no longer bearish on the pound over the long term.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

A jump in energy, water and other administered prices pushed UK inflation to 3.5% in April from 2.6%, data released on Wednesday showed. It was above the 3.4% forecast by the BOE and the 3.3% economists expected. Services inflation, watched closely by the BOE for signs of underlying price pressures, accelerated to 5.4% from 4.7%.

Article content

“This points to a more cautious approach from the BOE with a more stagflationary environment,” said Kirstine Kundby-Nielsen, FX analyst at Danske Bank.

Article content

The Bank of England cut interest rates by a quarter-point to 4.25% earlier this month in a decision that divided policymakers in three groups. Huw Pill, who voted for a hold, said on Tuesday he is concerned that rates are coming down too quickly and added the speed of disinflation in the economy is “stuttering.”

Article content

The pound’s decline also comes as the dollar weakens this week on speculation that finance ministers are discussing currency policies at their Group-of-Seven meeting this week.

Article content

Advertisement 1

.jpg) 5 hours ago

1

5 hours ago

1

English (US)

English (US)