Article content

(Bloomberg) — A strong US employment report caught investors in the $30 trillion Treasury bond market off guard, sending yields surging as traders lowered their expectations for Federal Reserve interest-rate cuts this year.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Yields on two-year notes — which are most sensitive to the central bank’s policy changes — jumped as much as 9.5 basis points to 3.55%, then eased back to 3.5% by the end of Wednesday’s trading session. Benchmark 10-year yields rose three basis points to 4.17% after a $42 billion auction of the securities saw demand fall short of expectations.

Article content

Article content

Article content

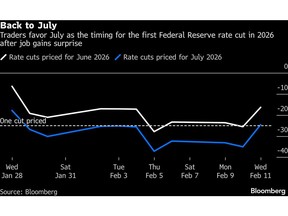

Traders had been bracing for a weak report based on other labor-market indicators and predictions of slower job growth in comments this week by two US administration officials. After the data they began pricing in the Fed’s next rate reduction in July, versus June previously. Those meetings fall after Fed Chair Jerome Powell’s term ends in May.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“The market came into this expecting a weak number and got the opposite,” said John Briggs, head of US rates strategy at Natixis. “As for market pricing of cuts, it’s falling as one would expect given the Fed’s focus on the labor market.”

Article content

Interest-rate swaps after the data showed traders see less than a 5% chance that policymakers lower rates when they meet in March. A total of 52 basis points of easing were priced in by December, compared with 59 basis points on Tuesday.

Article content

In listed interest-rate options, flows tied to the Secured Overnight Financing Rate were consistent with liquidation of hedges that targeted Fed rate cuts during the first half of this year. SOFR is a market rate that’s guided by the Fed’s policy rate.

Article content

The jobs report showed nonfarm payrolls increased 130,000 last month, about double the median estimate of economists surveyed by Bloomberg. The unemployment rate unexpectedly fell to 4.3% from 4.4%.

Article content

Article content

The strong readings invited speculation into how Kevin Warsh, President Donald Trump’s pick to become the next Fed chair, will handle policy.

Article content

Warsh, who needs Senate confirmation to succeed Powell, “might have a harder time convincing the hawks to vote for cuts, if that is in fact his bias,” said Subadra Rajappa, a strategist at Societe Generale. “The strong headline and uptick in wages argues for a more cautious approach to policy.”

Article content

Trump — who has been pressuring the Fed to lower borrowing costs — called the job report “great” on social media and said the US “should be paying MUCH LESS on its Borrowings (BONDS!).” He wrote that the US could save $1 trillion a year in interest cost, leading to a balanced budget. Interest expense on the debt in fiscal 2025 was $1.22 trillion.

Article content

On Wednesday, the Congressional Budget Office jacked up its estimate of deficits for the coming decade by $1.4 trillion, citing Trump’s 2025 tax law and immigration policies.

Article content

‘No Rush’

Article content

Overall, the jobs report — whose release was delayed by several days due to a US government shutdown — lent support to Fed officials who want to hold rates steady after three cuts last year to shore up the labor market. The December cut faced resistance from several policymakers who want to see inflation cool further.

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)