Article content

Every weekend, the Financial Post breaks down the most interesting developments in this week’s world of investing, from top performers to surprising analyst calls and stocks you should have on your radar. Here’s this week’s edition.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Stock of the week: BlackBerry Ltd.

Article content

Article content

Do investors at BlackBerry Ltd. (BB) finally have something to cheer about? That’s something analysts were musing about after shares of the smartphone pioneer turned cybersecurity play popped by nearly 12 per cent on Wednesday, following an earnings report that showed a first-quarter profit had turned positive. The Waterloo, Ont.-based company also “slightly” hiked its revenue forecast for the year. Though the stock pared some of its gains, BlackBerry shares still closed out the week up 4.7 per cent per cent at $6.21 in Toronto. BlackBerry had been among the Top-10 gainers on the S&P/TSX composite index as late as Thursday. The upbeat earnings lead Bloomberg Intelligence analysts to hazard that the tech firm “may be finding its footing” and were followed by a handful of price target increases. The biggest hike on the Toronto-listed shares came from CIBC Capital Markets, which raised its target to $8.24, a 30 per cent premium to Friday’s close.

Article content

Article content

Keeping score

Article content

Article content

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

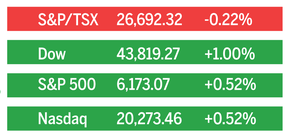

Trade war? What trade war? Optimism is back as S&P 500 hits new record

Article content

The S&P500 hit a new all-time high on Friday despite renewed trade tensions between the U.S. and Canada and analysts are optimistic that there are more gains to come on both sides of the border before the year is out. This week, Brian Belski, chief investment strategist at BMO Capital Markets, reconfirmed his base case for the TSX to hit 28,500 this year, hinging the forecast on several factors including “relatively resilient” Canadian growth, falling interest rates and improving stock valuations. “Our view in terms of Canadian equities remains resolute. Namely, Canada continues to provide strong relative value, a converging growth profile with the U.S. and improving equity flows,” Belski said in a note. The TSX is up 7.9 per cent year to date and almost 18.9 per cent since Donald Trump’s reciprocal tariffs announcement in early April. Belski’s base case implies an additional seven per cent return by year end, and though he thinks U.S. markets will be stronger through the end of the year, he still has the TSX as the net winner for 2025.

Article content

Article content

Rounding out the portfolio…

Article content

Article content

Costco Wholesale Corp. (COST) has been one of the market’s top performers over the past decade, but don’t let its big run scare you away. BMO Capital Markets food retail analyst Kelly Bania said the stock has more room to grow and confirmed Costco as a top pick in a note out this week. Her refreshed rating is based on three major announcements made recently by the company: a $10 monthly credit on same-day Instacart orders for executive members; extended shopping hours, also for executive members; and a standalone gas station test taking place in California. “These new benefits and perks highlight Costco’s extreme membership value proposition, particularly the key executive membership base, which accounts for 47 per cent of members but 73 per cent of sales,” Bania said. Bania has set a price target of US$1,175, a level the stock topped on Feb. 13 before slumping in March. Year to date, Costco is up 7.5 per cent and closed Friday at US$985.14.

Article content

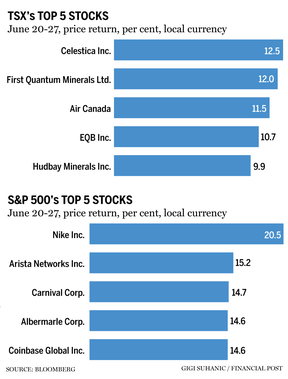

Nike Inc. (NKE) The sports-giant is back in the running after its latest earnings appeared to show Nike’s year-long sales slump is coming to an end. Deutsche Bank AG analyst Krisztina Katai lifted her target to US$77 Friday from US$71. Nike jumped 15 per cent on Friday and was trading at US$72.04.

.jpg) 5 hours ago

1

5 hours ago

1

English (US)

English (US)