Article content

Every weekend, the Financial Post breaks down the most interesting developments in this week’s world of investing, from top performers to surprising analyst calls and stocks you should have on your radar. Here’s this week’s edition.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Stock of the week: Empire Co. Ltd.

Article content

Article content

BMO Capital Markets raised its price target for Empire Co. Ltd. (EMP/A) after the grocery chain, which owns such brands as Sobeys, IGA, FreshCo, Foodland and Farm Boy, reported earnings that beat analyst estimates.

Article content

Article content

Earnings per share came in at 74 cents for the quarter ending May 3, beating analysts’ estimate of 71 cents. Empire’s profits increased 16.1 per cent to $173 million from $149 million in the same quarter a year ago.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Tamy Chen, a consumer analyst at BMO, raised her price target to $55 from $53 in late May.

Article content

“We are comfortable with our continued assumption for annual gross margin expansion of 20 basis points,” she said in a note. “For now, we are hesitant to assume further sequential acceleration in same-store sales.”

Article content

Chen said she would like to see continued improvement in operating costs because that will help drive EPS growth.

Article content

John Zamparo, an analyst at the Bank of Nova Scotia, raised his target to $62 from $49, while Mark Petrie at CIBC Capital Markets raised his to $59 from $55.

Article content

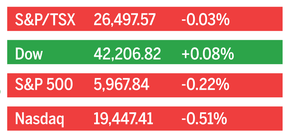

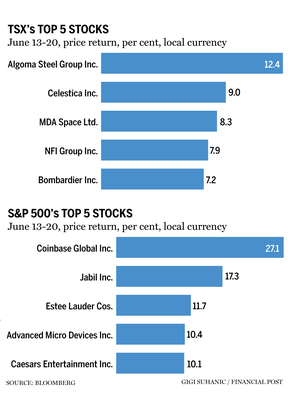

Keeping score

Article content

Article content

Article content

Article content

The war trade

Article content

The case for the defence trade “keeps getting stronger” as Israel and Iran continue to trade fire, David Rosenberg, head of Rosenberg Research & Associates Inc., said in a note this week, but that’s not the only tailwind.

Article content

“Military budgets are expanding sharply worldwide, and industry backlogs and production schedules are in acceleration mode,” he said.

Article content

Article content

For example, the Pentagon’s budget is just shy of US$1 trillion, and global military spending last year rose nearly 10 per cent to more than US$2.7 trillion as 36 countries were embroiled in armed conflict.

Article content

Article content

The S&P 500’s aerospace and defence index is up almost 30 per cent over the last year.

Article content

Its members include:

Article content

- General Electric Co. (GE)

- RTX Corp. (RTX)

- Boeing Co. (BA)

- Lockheed Martin Corp. (LMT)

- TransDigm Group Inc. (TDG)

- General Dynamics Corp. (GD)

- Northrop Grumman Corp. (NOC)

- Howmet Aerospace Inc. (HWM)

- Axon Enterprise Inc. (AXON)

- L3 Harris Technologies Inc. (LHX)

- Textron Inc. (TXT)

- Huntington Ingalls Industries Inc. (HII)

Article content

“I wish we lived in a peaceful world where we didn’t feel compelled to have this top the list of our highest-conviction ideas, but these are the cards we have been dealt, and our job is to help clients make money in a prudent fashion,” Rosenberg said.

Article content

He said investors who had already committed to the defence sector are reaping the rewards of United States President Donald Trump pushing North Atlantic Treaty Organization (NATO) members to meet their target of spending two per cent of their gross domestic product (GDP) on defence.

.jpg) 7 hours ago

1

7 hours ago

1

English (US)

English (US)