Article content

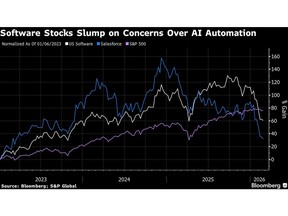

(Bloomberg) — The chief investment officer of UniSuper, one of Australia’s largest pension funds, is brushing aside concerns about the downturn in global tech stocks, saying that spending in the sector can support other parts of the market.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The selloff appears overdone, particularly for companies like Salesforce Inc. whose software is heavily integrated into business processes and tough to overhaul, said John Pearce, who oversees the A$166 billion ($117 billion) fund. Large artificial intelligence investments in tech firms could also boost revenues in other industries, he added.

Article content

Article content

Article content

“That is indeed why we are seeing a broadening of the market rally outside tech,” he said in an investment update Friday. “This is a very healthy development and once again demonstrates the benefits of diversification.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Concerns that AI will erode software-company revenues have triggered sharp market swings in the past few weeks. A US-listed exchange-traded fund tracking the sector has fallen 30% from a high last year, while Salesforce shares are near an almost three-year low and trade at about half their 2024 peak.

Article content

Pearce said while tech shares have faltered, energy and materials stocks have been climbing this year. Gold is also still holding on to gains despite a recent correction. While UniSuper has bought shares tied to bullion, it hasn’t purchased the metal directly.

Article content

Because gold doesn’t generate income, UniSuper treats it more like a currency, according to Pearce. The fund’s strategy “steers us away from speculating on currency movements,” allowing it to avoid losses when gold prices swooned, he said.

Article content

UniSuper had 35% of its balanced portfolio in international stocks as of Sept. 25. It lists Nvidia Corp., Microsoft Corp. and Apple Inc. among its major holdings.

Article content

In Australia, the market is “trudging along OK,” though the Reserve Bank’s policy pivot may weigh on shares, Pearce said. Still, this month’s interest-rate hike was “the right decision to make,” he added.

Article content

.jpg) 2 hours ago

2

2 hours ago

2

English (US)

English (US)