Article content

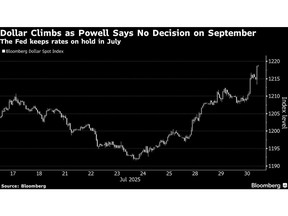

(Bloomberg) — US equity futures rose on robust tech earnings after a flat session on Wall Street. The Federal Reserve held interest rates, weakening Treasuries and leaving Asian equity futures mixed.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Microsoft Corp reported better-than-expected growth in its cloud business, while Meta Platforms Inc topped sales forecasts, sending shares in the two tech giants and US equity futures higher.

Article content

Article content

Article content

Contracts for Australia and Hong Kong declined while those for Japan edged higher, finding support from a weaker yen Wednesday as the dollar strengthened 0.8%. The S&P 500 fell 0.1% and Treasury 10-year yields rose around five basis points. While the concerted pullback in stocks and bonds looked mild, it marked the worst Fed day since December.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Fed Chair Jerome Powell said no decision had been made about easing policy in September. The US labor market “looks solid,” he said, while inflation remains above target.

Article content

The muted equity market response to the Fed hold was a sign investors have tempered expectations for imminent cuts. Instead, they’re leaning on resilient growth, an AI-fueled earnings boom, and the belief that tariffs will only trigger manageable goods inflation while leaving services inflation contained.

Article content

“To get that rate cut, the Fed will need to gain confidence that either inflation increases will be one-off and muted, or that inflation will continue to trend lower in the months and quarters ahead,” said Bret Kenwell at eToro.

Article content

Copper sank as President Donald Trump exempted the most widely imported form of the metal from his planned tariffs. The president also said he would impose a 25% tariff on India’s exports to the US starting Friday and threatened an additional penalty over the country’s energy purchases from Russia.

Article content

Article content

Trump also said he had reached a trade deal with South Korea that would impose a 15% tariff on its exports to the US and see Seoul agree to $350 billion in US investments.

Article content

Elsewhere in Asia, investors will be focused on a Bank of Japan rate decision, manufacturing data from China and gross domestic product for Taiwan and Hong Kong.

Article content

Fed Hold

Article content

The Federal Open Market Committee voted 9-2 on Wednesday to hold the benchmark federal funds rate in a range of 4.25%-4.5%, as they have at each of their meetings this year. Governors Christopher Waller and Michelle Bowman voted against the decision in favor of a quarter-point cut.

Article content

Money markets pared bets on rate reductions this year and traders now see a less than 50% chance of a cut in September. The odds for a reduction in October dropped to around 85%, whereas it was fully priced-in before Powell began to speak.

Article content

“The next two months’ data will be pivotal and we see a path to a resumption of the Fed’s easing cycle in the autumn should tariff inflation prove more modest than expected or the labor market show signs of weakness,” said Ashish Shah at Goldman Sachs Asset Management.

.jpg) 19 hours ago

1

19 hours ago

1

English (US)

English (US)