Article content

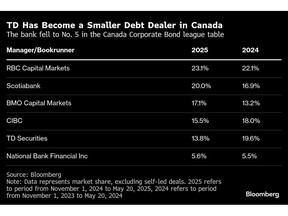

(Bloomberg) — In just a few months, Toronto-Dominion Bank’s ranking among Canadian bond underwriters has dropped to close to the bottom among its peers, after an exodus of fixed-income professionals.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

TD Securities has led less than 14% of Canadian corporate bond sales since the beginning of the fiscal year in November, according to data compiled by Bloomberg. That puts the firm at fifth of Canada’s six systematically important banks, compared with second place for the same period a year earlier.

Article content

Article content

It’s a rare tumble for the bank in a typically low-drama business. TD has been in one of the top three spots for Canadian corporate bond sales from November through May 20 for every year since the period beginning Nov. 1, 2018. The figures exclude sales of bonds issued by the banks themselves, known as self-led deals.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

TD has seen a drop in public sector bond sales as well, according to data compiled by Bloomberg. The decline of the bank in league tables — scoreboards for banks’ capital market activities — coincided with a series of high-profile departures and leadership shakeups at the firm.

Article content

In October, the bank agreed to pay almost $3.1 billion in fines and other penalties after pleading guilty to conspiracy to commit money laundering. The bank slashed bonuses for some executives as a result.

Article content

The bank, the second largest in Canada by stock market value, says it remains focused on bond underwriting, also known as the debt capital markets business.

Article content

“TD is a long-term leader in DCM globally, and we remain fully committed to this market, as evidenced by our continued acceleration in the US, and key hires in the broader Canadian fixed income business,” a bank spokesperson said in a statement. “We are particularly focused on providing leading DCM advisory services in Canada which we continue to view as a key strategic market.”

Article content

TD has been slipping in league tables for months, as key personnel have left the firm. Departures included Jason Cope, TD’s former head of global fixed income; Sameer Rehman, a director in government finance; and David Gourlay, a former managing director and head of Canadian government credit trading and origination.

Article content

TD’s settlement with US law enforcement and regulators has triggered a broader overhaul at the firm, including the sale of its remaining stake in Charles Schwab Corp. for $13.9 billion after taxes and fees.

Article content

—With assistance from Christine Dobby and Lauren Tara LaCapra.

Article content

.jpg) 6 hours ago

1

6 hours ago

1

English (US)

English (US)