Article content

(Bloomberg) — Japan’s stock market is poised to extend its rally while the nation’s currency and bonds are vulnerable to further declines after a strong showing by Prime Minister Sanae Takaichi’s Liberal Democratic Party in Sunday’s lower house election.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Local media reported the LDP had secured a majority in the lower house. Public broadcaster NHK forecast that the ruling coalition may take two-thirds of the seats, a result that exceeds what some investors had positioned for in recent weeks.

Article content

Article content

Article content

“Overall, the election results are welcome news for the Nikkei given the clear outcome and clearer political path for Takaichi’s stimulus policies,” said Tim Waterer, chief market analyst at KCM Trade. “The yen could be further pressured however with the LDP’s fiscal stimulus plans effectively given the ‘green light’.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The benchmark Topix index, which closed at a record high on Friday, has rallied more than 8% this year, while a global measure of developed-market equities eked out a gain of just around 2%, on expectations that higher spending advocated by Takaichi will fuel economic growth.

Article content

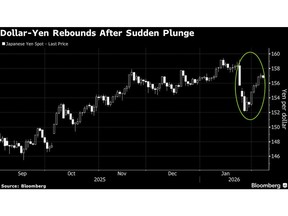

The yen retreated 1.6% last week to 157.22 to the dollar, leaving it within reach of a zone around 160 versus the greenback that has previously drawn Japanese authorities into the market to defend the currency.

Article content

“This is a very strong result for the LDP, although not entirely unexpected by markets,” said Rong Ren Goh, a fixed income portfolio manager at Eastspring Investments. “Both JGB yields and the yen have been consolidating over the past couple of weeks into the election, so the outcome should now allow markets to re-engage existing trends.”

Article content

Article content

Many investors pointed to the likelihood of the so-called Takaichi trades dominating market focus Monday. One contrarian to be tested is the danger that Takaichi doing so well means she may in fact feel less pressure to deliver stimulus.

Article content

In stocks, the most obvious areas to watch are sectors such as defense and nuclear energy, which dovetail with Takaichi’s investment agenda for the nation.

Article content

“Japanese equities are poised to rally from this victory,” said Gerald Gan, chief investment officer at Singapore-based Reed Capital Partners. “Sectors that Sanae Takaichi wishes to boost spending such as military, AI and semiconductors will likely be the biggest beneficiaries.”

Article content

The yen’s weakness has been a double-edged sword for Japan, on the one hand raising profits for the country’s exporters, but on the other squeezing the budgets of ordinary households.

Article content

Its steady slump since Takaichi took over the LDP leadership in September was briefly checked late last month amid signs that US and Japanese authorities may unite to shore up the currency. That’s been undone in recent weeks amid mixed signals from both sides.

.jpg) 2 hours ago

3

2 hours ago

3

English (US)

English (US)