Article content

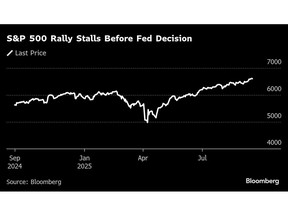

(Bloomberg) — Stocks treaded water as markets saw muted moves across most asset classes, with traders taking bets off the table ahead of Wednesday’s Federal Reserve interest-rate decision.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

With equities near record highs, the quiet tone belies uncertainty over how the Fed will signal the path for rates, with a quarter-point cut at this meeting and three more by April already priced in. The risk is that policymakers — tasked with protecting the job market — sound less dovish to keep inflation in check.

Article content

Article content

Article content

Listen to the Stock Movers podcast on Apple, Spotify or anywhere you listen

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Also looming over the meeting is the standoff over Fed policy, with President Donald Trump’s hard-charging push for lower borrowing costs clashing with Fed Chair Jerome Powell’s hitherto cautious stance on tariff-driven price pressures.

Article content

“There’s the potential for big divergence between officials,” wrote Deutsche Bank AG strategist Jim Reid. “There’s also the possibility of multiple dissents. The last meeting saw two governors dissent for the first time since 1993, whilst Trump-appointee Stephen Miran has also joined the board now.”

Article content

S&P 500 and Nasdaq 100 futures were little changed. Nvidia Corp. fell 1.2% in premarket trading after a Financial Times report that a Chinese watchdog ordered the country’s biggest tech firms to terminate orders for the RTX Pro 6000D product.

Article content

European stocks nudged 0.2% higher to recoup some of the previous session’s losses. MSCI’s gauge for Asian equities hovered at an all-time high. Bloomberg’s gauge of the dollar held near the lowest since 2022.

Article content

Article content

Global bond markets posted modest gains, with the yield on 10-year Treasuries falling two basis points to 4.01%. Gold retreated from a record after briefly breaking through $3,700 an ounce in the previous session.

Article content

Alongside the expected 25 basis-point cut, investors will also pore over the Fed’s latest quarterly rate projections, known as the dot plot. Back in June, the Fed penciled in three cuts through the end of 2026, compared to nearly six priced in now by traders.

Article content

“The Fed is likely to balance this against still-elevated services inflation, maintaining a degree of flexibility in its messaging,” wrote Gabriele Foà, Portfolio Manager at Algebris Investments. “Today’s meeting is set to mark the official start of the easing cycle, with the Fed signalling that future moves will remain data dependent.”

Article content

Article content

Corporate Highlights:

Article content

- China’s internet watchdog has instructed companies including Alibaba Group Holding Ltd. and ByteDance Ltd. to terminate orders for Nvidia Corp.’s RTX Pro 6000D, the Financial Times reported, citing people with knowledge of the matter.

- Apple Inc.’s smartphone sales in China in the weeks leading up to the iPhone 17 launch fell 6% from the year-earlier period, a deeper slump than is typical ahead of a new flagship product release.

- Qatar’s $524 billion sovereign wealth fund is nearing a deal to buy a minority stake in Canada’s Ivanhoe Mines Ltd., according to people familiar with the matter.

- Hellman & Friedman-backed alarm firm Verisure Plc announced it’s planning to raise about €3.1 billion ($3.7 billion) via an initial public offering in Stockholm.

- Microsoft Corp., OpenAI and other American companies announced plans to spend tens of billions of dollars on technology infrastructure in the UK, part of a series of business deals that coincide with Trump’s visit to the nation this week.

- TikTok’s US operations would be acquired by a consortium that includes Oracle Corp., Andreessen Horowitz and private equity firm Silver Lake Management LLC under a deal Trump is set to discuss with Chinese President Xi Jinping this week.

- Nestlé SA Chairman Paul Bulcke will step down early after investors questioned his handling of the ouster of the food company’s former chief executive officer due to an undisclosed romantic relationship with a subordinate.

- Chery Automobile Co. is seeking to raise as much as HK$9.1 billion ($1.2 billion) in a Hong Kong initial public offering, kicking off what’s shaping up to be a busy final stretch to the year for big listings in the financial hub.

.jpg) 2 hours ago

3

2 hours ago

3

English (US)

English (US)