Article content

(Bloomberg) — Asian stocks advanced alongside Treasuries after softer US jobs data strengthened bets on a Federal Reserve interest-rate cut.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The MSCI Asia Pacific Index gained 0.4%. Technology shares rose, reversing early weakness, and futures contracts for the Nasdaq 100 index gained 0.4%. Advanced Micro Devices Inc. jumped 4.8% in extended US trading after it predicted accelerating sales growth. Contracts also indicated European shares will rise at the open.

Article content

Article content

Article content

Job figures from ADP Research signaled the labor market slowed in the second half of October, sending bonds higher across the curve. The 10-year yield dropped three basis points to 4.08% as traders added to bets on Fed rate cuts, pricing roughly a 70% chance of a reduction next month. A gauge of the dollar edged up after five days of losses, while gold fell.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

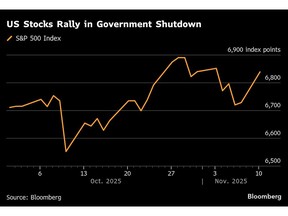

The US government’s closure had heightened the importance of private data such as ADP, with investors deprived of key official indicators to gauge the strength of the economy. The record shutdown is now on track to end as soon as Wednesday, after the Senate passed a temporary funding measure that buoyed stocks as investors brace for a flood of delayed data once agencies reopen.

Article content

“As government functions resume, we expect a clearer read on the economic data, an important step for assessing the underlying strength of US activity,” said Rajeev De Mello, a global macro portfolio manager at Gama Asset Management. “Investor positioning is adjusting to a confluence of supportive factors.”

Article content

US companies trimmed 11,250 jobs per week on average in the four weeks ended Oct. 25, according to data released Tuesday by ADP Research. The firm’s most recent monthly report, released last week, showed private-sector payrolls increased 42,000 in October after declining in the prior two months.

Article content

Article content

The data come after an array of companies flagged plans to reduce headcount in recent weeks. A report from outplacement firm Challenger, Gray & Christmas Inc. showed employers announced the most job cuts for any October in more than two decades, spurring anxiety about the health of the labor market.

Article content

“The market will be guided by the general risk vibe and Fedspeak, but we suspect it will be unable to establish consistent directional impetus,” Westpac Banking Corp. strategists Damien McColough and Uma Choudhury wrote in a note.

Article content

The reopening of the US government now depends on the House, which plans to return to Washington to consider the spending package. It would keep most of the government open through Jan. 30 and some agencies through Sept. 30.

Article content

If approved, the bill goes to President Donald Trump, who has already endorsed the legislation.

Article content

What Bloomberg strategists say…

Article content

Global equities may struggle to regain full momentum unless the path to central bank easing in the US and other major economies becomes clearer. AI bubble angst is also playing a role, but then that is obscuring the headwind for stocks being generated by expectations that the pace of interest-rate cuts is set to slow down.

.jpg) 2 hours ago

2

2 hours ago

2

English (US)

English (US)