Article content

(Bloomberg) — For most of last year, investors were warned that hiding out in Big Tech was becoming a dangerous move. Turned out that wasn’t great advice.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

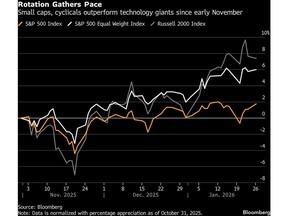

Up until November, the Magnificent Seven technology giants, including Nvidia Corp, Microsoft Corp. and Amazon.com Inc., accounted for most of the market’s double-digit advance. Since then, though? It’s been a different story.

Article content

Article content

Article content

The long-forecast rotation from tech is set to enter its fourth month, and few on Wall Street expect it to end. A version of the S&P 500 Index stripped of market-cap bias has jumped 6% since early November while the standard version has added just 1.6%. Materials, health care and consumer sectors have supplanted tech at the forefront. Small caps in the Russell 2000 Index have soared more than 7%. The Invesco S&P 500 Equal Weight exchange-traded fund (RSP) has taken in $4.8 billion this year through Friday, the third-most among about 1,500 US equity-focused ETFs.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Optimism that the American economy is set to take off has fueled the rotation, with companies whose fortunes are closely tied to the business cycle attracting investor cash. At the same time, artificial intelligence investing has become less monolithic in the tech sector, with investors starting to choose winners and losers.

Article content

“Street expectations for the next few years suggest that whether due to fiscal policy changes, monetary policy changes, the long-awaited industrial cycle or a mixture of all three, growth is set to broaden out considerably,” said Andrew Greenebaum, senior vice president of equity research product management at Jefferies LLC.

Article content

Article content

The optimism is not without risks. The labor market remains cool, geopolitical tensions have heightened and domestic unrest may lead to another government shutdown. And, of course, calls for tech’s demise have failed to materialize for years now.

Article content

Still, there are signs of measurable improvement in market breadth and earnings growth expanding into erstwhile laggards. Big Tech profit gains that have long outstripped the rest of the S&P 500 are set to narrow at the same time investors are becoming more concerned about massive tech capital outlays.

Article content

“Tech sector and Magnificent Seven leadership have stalled since the end of October, with investors embracing the call for broadening earnings growth,” Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management, said in a Jan. 26 note to clients. “Consider preparing for new equity index leadership.”

Article content

Greenebaum points to three areas in the market when conveying the “realness” of the rotation to clients. The first is the Russell 2000’s outperformance compared to large caps at the same time cyclicals in the S&P 500 have taken up the mantle from tech. Investment flows into small caps have “improved considerably” over the last several months, he said. Finally, he expects small caps to deliver a bigger rate of earnings growth.

.jpg) 1 hour ago

3

1 hour ago

3

English (US)

English (US)