Article content

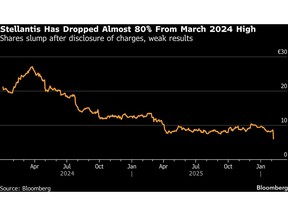

(Bloomberg) — Fourteen months after Stellantis NV parted ways with a chief executive officer who surprised investors with wayward results, his successor has pulled a similar move.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

CEO Antonia Filosa on Friday announced €22.2 billion ($26 billion) in charges, much of which were linked to unwinding his predecessor Carlos Tavares’ bets on electric vehicles that were destined to be unprofitable.

Article content

Article content

Article content

Beneath that headline figure, though, Stellantis also released far weaker earnings than analysts had anticipated — based in part on reassurance Filosa offered only two months ago. The disclosures sent the Jeep and Fiat maker’s stock plunging 25% intraday in Milan trading.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

While much of Stellantis’ slide from an all-time high reached less than two years ago occurred under Tavares, who caught investors off-guard with a profit warning toward the end of his tenure, the rout has only worsened under Filosa. The company has now lost almost €70 billion of market value since March 2024.

Article content

The extreme move in Stellantis stock relative to how Ford Motor Co. and General Motors Co. shares swung following their disclosures of similar EV-related writedowns is telling, Bernstein analyst Stephen Reitman wrote in a report to clients. It reflects “the chasm that Stellantis management needs to bridge to reestablish trust,” he said.

Article content

Filosa, 52, said at an investor event in early December that the company was on track to meet its full-year guidance.

Article content

On Friday, however, the company warned it’s expecting to report a second-half deficit of as much as €1.5 billion, “much worse” than expected, Evercore ISI analyst Chris McNally wrote in a report. He also called Stellantis’ outlook for 2026 “vague” — the manufacturer forecast a mid-single-digit increase in revenue, and a low-single-digit adjusted operating income margin.

Article content

Article content

Alongside the €22.2 billion in writedowns, Stellantis is selling its 49% stake in a Canadian joint venture to partner LG Energy Solution Ltd. for just $100, wiping out virtually all of the $980 million the carmaker had invested in the operation. Stellantis and the South Korean battery maker partnered in 2022 to build the first large-scale EV battery plant in Windsor, Ontario.

Article content

A significant chunk of the charges Stellantis announced was unrelated to Filosa’s moves to cancel EVs that are falling short on both sales and profitability.

Article content

The company also said it will take a €4.1 billion hit related to how it provisions for warranty expenses, citing quality issues blamed on previous management. Another €1.3 billion of other charges mainly relate to previously announced job cuts in Europe.

Article content

Filosa has touted traction at Stellantis’ all-important Ram truck and Jeep SUV brands, with pickup buyers taking interest both in the Hemi V-8 engine and the Cherokee model brought back last year. Jeep just snapped a six-year streak of declining US sales, with deliveries rising 4% in the fourth quarter, when many other brands lost momentum.

Article content

Investors who are bullish on Stellantis stock “will say this is a ‘kitchen sink’ moment and could be a cleaning event,” Tom Narayan, an analyst at RBC Capital Markets, said in a note. “We await further evidence of a turnaround in business fundamentals, however.”

Article content

(Updates with JV stake sale in eighth paragraph.)

Article content

.jpg) 1 hour ago

3

1 hour ago

3

English (US)

English (US)