Article content

(Bloomberg) — Before the trading day starts we bring you a digest of the key news and events that are likely to move markets. Today we look at:

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

- Asset managers in play

- IPO fever continues

- Home sales slow

Article content

Article content

Good morning, this is Alex Gabriel Simon, an equities reporter in Mumbai. India’s equity bulls appear to be on the back foot after Nifty’s losses in three of the past four sessions. While regional markets are showing strength — helped by gains on Wall Street — the support may prove limited as the rupee remains under pressure. Meanwhile, Indian stocks could face fresh competition from China, with the number of Chinese companies included in MSCI’s global stock indexes rising for the first time in nearly two years. Investors will also be watching earnings reports today from Life Insurance Corp., Bajaj Housing Finance, ABB India, and Apollo Hospitals.

Article content

Article content

State Street eyes India’s mutual fund boom

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The world’s fourth-largest asset manager is the latest to join global giants seeking to tap into India’s fast-growing asset management industry. State Street Investment Management is in talks to buy a stake in a local asset manager and is also planning to offer model portfolios of foreign stocks to retail investors. With the potential move, the investing giant would join the likes of BlackRock, Amundi, and Schroders in targeting the country’s vast retail investor base — and a market nearing $1 trillion in assets. It’s a telling sign that, despite Indian equities lagging regional peers this year, a shifting investing culture is keeping appetite strong. Mutual funds continue to see steady inflows, and IPOs are drawing record subscriptions.

Article content

India’s IPO investors unfazed by lofty valuations

Article content

Speaking of IPOs, Lenskart’s $821 million issue closed its three-day bidding with demand at 25 times the shares offered, even as some investors fretted over its stretched valuation. Peer startup Groww, India’s top discount broker, saw half its IPO sold on the first day — a solid start by any measure. Demand remains strong across investor categories. Interestingly, foreign investors — net sellers in the secondary market — continue to show up for new listings. Many of these companies are tech-led or platform-driven, offering growth stories legacy firms can’t match, even if valuations look rich. Think Eternal, still trading at eye-watering multiples — or Paytm’s parent, a cautionary tale of when such bets go wrong.

Article content

Article content

Mumbai home sales hit soft patch

Article content

In another corner of the economy, things are not as upbeat. The number of housing units registered in Mumbai fell 10% year-on-year in October, while the value of registrations declined 14%, according to Nuvama analysts. They note that that high prices are deterring buyers, with no easy fix for near-term problems like falling affordability, inadequate mid-income houses, and a weak job market. They expect moderate growth in home prices going ahead, and that could keep stocks range bound. Mumbai-based developers such as Lodha, Oberoi, Godrej Properties, and Sunteck may face continued pressure.

Article content

Analysts actions:

Article content

- AU Small Finance Cut to Accumulate at Arihant Capital

- Bharti Hexacom Raised to Add at ICICI Securities

- Greenply Raised to Add at ICICI Securities; PT 336 rupees

Article content

Three great reads from Bloomberg today:

Article content

- India’s Poorest State Goes to Polls in Test of Modi’s Strength

- China’s MSCI Presence Expands for First Time in Nearly Two Years

- Big Take: The Attacks That Rocked India’s US, Canada Relations

Article content

And, finally..

Article content

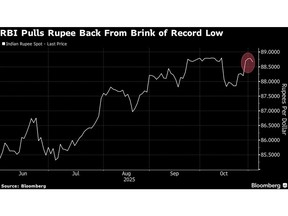

The rupee, which came close to a record low earlier this week, rebounded sharply on Tuesday, posting its biggest gain in more than two weeks. Traders cited dollar sales by the Reserve Bank of India in the forwards market. The move comes after strong intervention by the central bank in mid-October and signals that the RBI is unlikely to let the currency slip past its previous record low of 88.8850 per dollar, reached in September.

Article content

Article content

Article content

To read India Markets Buzz every day, follow Bloomberg India on WhatsApp. Sign up here.

Article content

Article content

—With assistance from Kartik Goyal and Ashutosh Joshi.

Article content

.jpg) 2 hours ago

3

2 hours ago

3

English (US)

English (US)