Article content

(Bloomberg) — A British power generator’s outline of its £33 billion ($43 billion) plan to overhaul grids and accommodate the rapid expansion of renewable energy has put the stock on track for its best week in a quarter-century.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

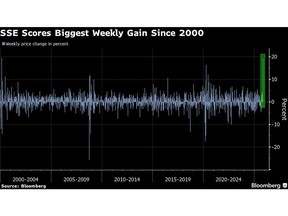

London-listed SSE Plc has seen its shares surge 18% in what’s set to be its best week since February 2000. Investors welcomed news of a £2 billion share sale that will partly fund the growth plan, given the equity raise is at the lower end of previous scenarios, according to analysts.

Article content

Article content

Article content

“The promised growth alongside this spending is clearly helping the market warm to the deal, with the intention being to continue growing dividends too,” noted AJ Bell investment director Russ Mould.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Investors and analysts have been seeking clarity on how SSE — which generates, transmits, distributes and supplies power to customers in the UK and Ireland — plans to fund its ambitious goals in the years ahead. Before this week, the shares had been lagging behind peer National Grid Plc.

Article content

The funding plan and medium-term guidance will “most likely remove the overhang that we believe has weighed on the stock for the last 12 months,” Morgan Stanley analyst Robert Pulleyn wrote in a note this week. “We expect the strategy and funding plan will trigger a sustained re-rating.”

Article content

The stock currently trades at 12.7 times expected earnings, meaning its valuation is still cheaper than National Grid and the broader Stoxx 600 Utilities Index.

Article content

Analysts are overwhelmingly positive on the stock, with more than 80% rating SSE a buy or equivalent. Still, not everyone is optimistic about this week’s rally: Citigroup Inc. analyst Jenny Ping downgraded her recommendation to sell from neutral, calling the recent share moves “excessive.”

Article content

Article content

For AJ Bell’s Mould, delivering on the roadmap by the end of the decade will be challenging. “Shareholders and stakeholders will be keeping a beady eye on SSE’s progress on this front for delays and any cost over-runs,” he said in emailed commentary.

Article content

Some see more upside for the shares. RBC Capital Markets increased its price target on Friday, with the new projection suggesting the stock could rise more than 10% from current levels. “SSE’s equity raise removes balance sheet concerns, whilst the strategic plan highlights a strong growth business in high quality networks,” analyst Alexander Wheeler wrote in a note.

Article content

—With assistance from Paul Jarvis and Eamon Akil Farhat.

Article content

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)