Article content

(Bloomberg) — Chinese oil refiners are shunning Russian shipments after the US and others blacklisted Moscow’s top producers and some of its customers.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

State-owned giants such as Sinopec and PetroChina Co. are staying on the sidelines, having canceled some Russian cargoes in the wake of US sanctions on Rosneft PJSC and Lukoil PJSC last month, according to traders. Smaller private refiners, dubbed teapots, are also holding off, fearful of attracting similar penalties to those faced by Shandong Yulong Petrochemical Co., which was recently blacklisted by the UK and European Union.

Article content

Article content

Article content

The Russian crudes affected include the widely-favored ESPO grade, which has seen prices plunge. Consultancy Rystad Energy AS estimates some 400,000 barrels a day, or as much as 45% of China’s total oil imports from Russia, are affected by the buyers’ strike.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Russia has cemented itself as China’s biggest foreign supplier, in part because its oil is so heavily discounted due to the penalties imposed by other countries after the invasion of Ukraine.

Article content

The US and its allies are now ratcheting up those sanctions, on both Russian producers and their customers, in a bid to stop the war by choking off Moscow’s oil revenues. China is the world’s biggest crude importer, and any constraints on sourcing from its neighbor are likely to work to the benefit of other suppliers.

Article content

Those could include the US, which agreed a landmark trade truce with Beijing at a meeting last week between leaders Donald Trump and Xi Jinping. But the sanctions aren’t a total loss for Moscow. Blacklisted Yulong, which has had cargoes canceled by western suppliers, has turned heavily to Russian oil because of a lack of other options.

Article content

Article content

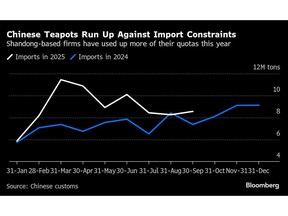

Meanwhile, other private refiners are watching developments and refraining from actions that could trigger similar sanctions, according to Rystad. In any case, teapots are running up against a shortage of import quotas for crude oil, after tax changes shrank their use of other feedstocks. That’s likely to impede teapots’ purchases of Russian oil for the remainder of the year even if they were willing to skirt sanctions.

Article content

And if anything, the meeting between Trump and Xi has only added to the muddle. While the leaders were able to establish new ground rules for trade in items like semiconductors, rare earths and soybeans, what to do about Russian oil wasn’t mentioned in any public readouts.

Article content

On the Wire

Article content

China will effectively suspend implementation of additional export controls on rare earth metals and terminate investigations targeting US companies in the semiconductor supply chain, the White House announced.

Article content

A dramatic rebound in clean-tech stocks has investors in the green economy hoping they can finally turn the page on years of punishing underperformance.

.jpg) 7 hours ago

2

7 hours ago

2

English (US)

English (US)