Article content

(Bloomberg) — Russia may halt or slow its cycle of interest-rate cuts this week as Ukrainian attacks on refineries and a looming tax increase stoke inflation risks.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Despite the economy struggling under the weight of lofty borrowing costs that the central bank only began cutting in June, Governor Elvira Nabiullina’s team has signaled growing caution before Friday’s policy meeting.

Article content

Article content

Article content

In one telling exchange last week, Alexey Zabotkin, one of her deputies, promised only a “balanced decision” reflecting “all available information” when urged by lawmakers to deliver relief for the budget and businesses.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

That’s left economists split on the outcome of Friday’s meeting. About half predict a cut from the key rate’s current level of 17%, while the rest foresee no change. The central bank will announce its decision at 1:30 p.m. Moscow time, followed by a 3 p.m. briefing.

Article content

“The recent acceleration in price growth and the rise in inflation expectations are limiting the space for rate cuts,” said Moscow-based Renaissance Capital’s chief economist, Andrei Melaschenko. He sees the central bank either standing pat or moving more cautiously with a half-point cut, following September’s full-point reduction.

Article content

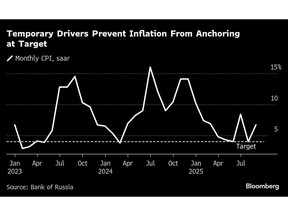

After briefly aligning with the Bank of Russia’s 4% goal, inflation has picked up once again. Part of the reason is the end of seasonal factors like the summer drop in fruit and vegetable costs, while the effect of a stronger ruble is also fading.

Article content

More to blame, however, are fuel shortages. With the Kremlin showing little interest in negotiating an end to the war it started in 2022, Ukraine is stepping up strikes on energy infrastructure including refineries, oil pipelines and sea terminals. Gasoline prices jumped 3% in September and have risen another 2% this month.

Article content

Article content

The situation is worsening an already fragile inflation outlook. The central bank expects higher recycling fees for imported cars to squeeze the availability of such vehicles, and estimates that a plan to lift value-added tax to 22% from 20% in 2026 — to finance ballooning defense outlays — will add 0.6-0.8 percentage points to consumer-price gains.

Article content

Such initiatives risk undermining a pullback in households’ perceptions of future inflation, potentially reducing the scope for policy to be loosened.

Article content

“In an environment where several, temporary pro-inflationary factors are overlapping, monetary policy must consider their cumulative impact on the process of lowering inflation expectations,” the central bank said this month. “The timing and room for rate cuts will depend on how strong that impact proves to be.”

Article content

Inflation expectations held at 12.6% in October.

Article content

The central bank has said decisions must remain “calibrated” and “cautious.” To hit its inflation target by the end of next year, it reckons seasonally adjusted monthly numbers must stay close to 4% for an extended period.

.jpg) 4 hours ago

3

4 hours ago

3

English (US)

English (US)