Article content

Strong flows from retail investors are likely to support stocks into year-end, according to JPMorgan Chase & Co. strategists.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

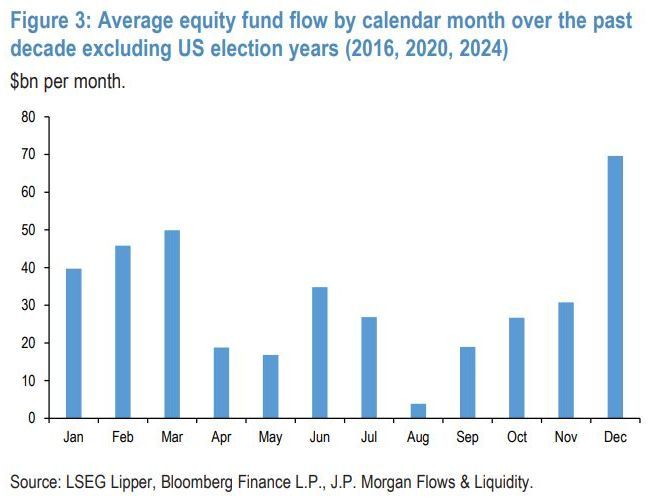

The forecast is based on seasonal patterns observed in a study of equity fund flows over the past decade, the team led by Nikolaos Panigirtzoglou said in a note. Outside of U.S. election years, average flows tend to be higher in December and in the first quarter that follows, they found.

Article content

Article content

Article content

The S&P 500 index has just notched its sixth month of gains, the longest such winning streak since August 2021, rising almost six per cent in September and October. The benchmark has set 36 record highs this year as enthusiasm over the growth of artificial intelligence powers an advance in tech megacaps.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“From a seasonality point of view, the strong momentum in the retail impulse into equities seen over the previous two months is likely to be sustained into early 2026,” Panigirtzoglou and his colleagues wrote.

Article content

Article content

Stronger retail demand for stocks in September and October showed up in the amount of money heading into vehicles such as exchange-traded funds. “In particular, equity ETFs saw $160 billion of inflows in each of the previous two months, the strongest pace of equity ETF buying since Nov./Dec. 2024 after the US election,” the strategists said.

Article content

The global stock rally has faltered over the past few days, as concerns over excessive valuations in the technology sector prompted some profit taking. Retail investors’ favorite trades including AI-related stocks and crypto currencies took a hit. A U.S. government shutdown and conflicting headlines from United States Federal Reserve officials about the path of interest-rate cuts also dragged on sentiment.

Article content

Article content

Over at Goldman Sachs Group Inc., partner Richard Privorotsky said “retail is being tested for the first time in a while.” A drop in crypto assets and pressure on shares in unprofitable tech companies make sense as capital rotates within the equity market, he said.

Article content

Article content

He does not expect any pullback in stocks to last long.

Article content

“Ultimately equities are going to be a buy on the dip,” Privorotsky said, adding that fiscal expansion, corporate profits and money supply make real assets the only place to hold wealth.

Article content

Article content

.jpg) 12 hours ago

3

12 hours ago

3

English (US)

English (US)