Article content

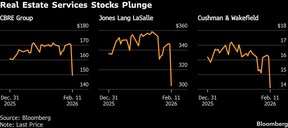

Real estate services stocks sank Wednesday as investors assessed the companies’ vulnerability to the newest crop of artificial intelligence applications and tools that threatens to disrupt several industries.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Shares of CBRE Group Inc. plunged as much as 15 per cent, Jones Lang LaSalle Inc. slid 13 per cent and Cushman & Wakefield Ltd. fell 15 per cent. For all three firms, the moves mark the biggest drop since March 2020 in the midst of the COVID-driven market selloff.

Article content

Article content

Article content

“We believe investors are rotating out of high-fee, labour-intensive business models viewed as potentially vulnerable to AI-driven disruption,” Keefe, Bruyette & Woods analyst Jade Rahmani wrote in a note to clients on Wednesday.

Article content

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Still, the analyst also notes that the selloff “may overstate the immediate risk to complex deal-making, even as the long-term AI impact remains a ‘wait-and-see’.”

Article content

The group is the latest to get caught up in what Rahmani calls the “AI scare trade,” after investors rushed to dump shares of software firms, private credit companies, wealth managers and insurance brokers within the span of just over a week.

Article content

The fears came to the fore last week after AI startup Anthropic released tools aimed at automating work tasks in areas ranging from legal services to financial research. At the same time, analysts and investors have warned that some of this steep selling reflects a knee-jerk reaction and could be overestimating some of the risk.

Article content

—With assistance from Arvelisse Bonilla Ramos.

Article content

Article content

We apologize, but this video has failed to load.

Article content

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)