Article content

Market-making firms in the US$13 trillion exchange-traded fund industry may come under strain amid a potential wave of new listings in 2026, with U.S. regulators poised to allow asset managers to offer ETFs as share classes of mutual funds.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

That’s the view of Valerie Grimba, director of global ETF strategy at RBC Capital Markets, which is one of the top-10 largest ETF market-makers. Specifically, market-makers don’t have unlimited capital to devote to trading ETFs intraday and seeding new fund launches, Grimba said. Should the introduction of dual-share classes in 2026 spur hundreds of new listings, as some industry watchers have called for, the market-making system could run into a bottleneck of sorts, she said.

Article content

Article content

Article content

“There are some finite resources in the system. One that’s very important is, of course, a balance sheet, or capital that is put up by market makers,” Grimba said on Bloomberg Television’s ETF IQ. “That is a finite resource that probably is going to be constrained if you see the number of ETFs grow.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Anticipation is building for the first ETF share classes of mutual funds to launch early next year after the U.S. Securities and Exchange Commission gave Dimensional Fund Advisors formal approval to do so last month. Dozens of other firms are waiting for similar approval, including BlackRock Inc., Fidelity Investments and T. Rowe Price Group.

Article content

Article content

However, Grimba isn’t alone in her concerns about the burden that the dual-share class structure could place on the ETF ecosystem. Potential operational and market-structure challenges have kept issuers such as Capital Group away from filing for permission to use the fund blueprint, while Nasdaq Inc. is staffing up ahead of the potential deluge.

Article content

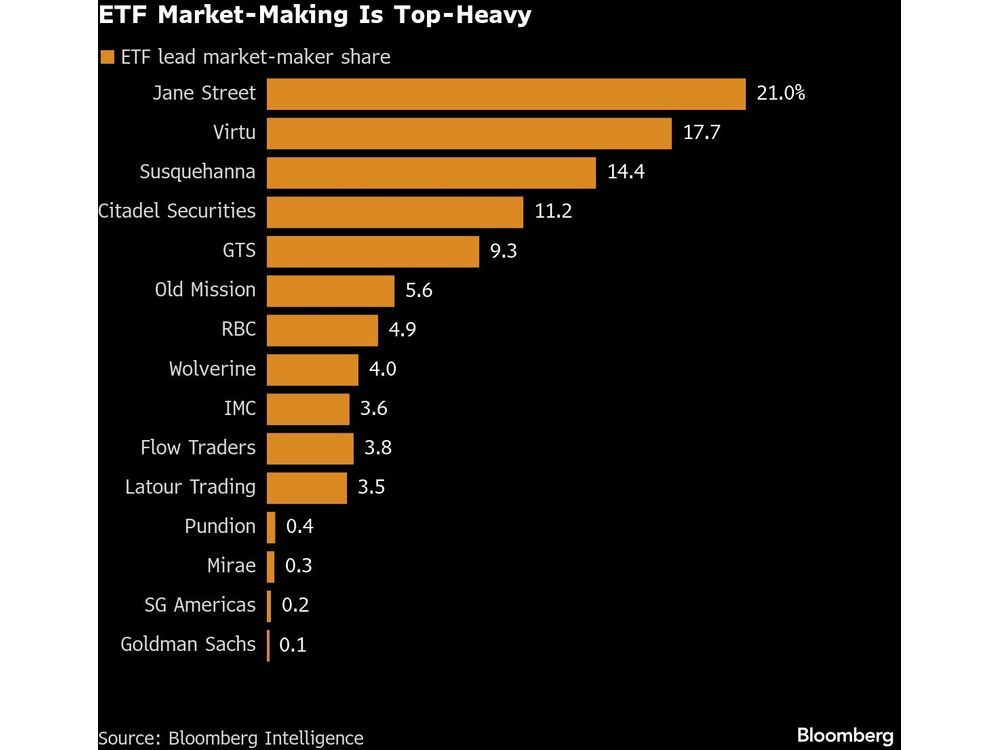

At the heart of the concerns is the fact that the ETF industry is served by a concentrated handful of market-makers. While there are more than 250 ETF issuers, there are only 15 market-making firms serving the industry, with the top five — Jane Street, Virtu, Susquehanna, Citadel Securities and GTS — acting as lead market maker for more than 70 per cent of ETFs, according to Bloomberg Intelligence.

Article content

Article content

Market-makers are going to prioritize working with the asset managers that they already have an economic relationship with, such as trading during index rebalances or partnering on derivative structures, Grimba said.

Article content

Article content

“Market makers are going to be more selective with the ETF issuers that they work with,” Grimba said. “We just want to make sure that even the smaller, more innovative ETF asset managers are able to come to market and not be hamstrung by us just working the with largest providers.”

Article content

Article content

.jpg) 2 hours ago

3

2 hours ago

3

English (US)

English (US)