Article content

(Bloomberg) — Australia’s central bank chief Michele Bullock strode into a committee room in Parliament House on Friday morning primed to explain what’s causing the inflation that forced this week’s interest-rate hike — the world’s first of 2026.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

As opposition lawmakers scented an opportunity to land a political blow on the dominant government of Prime Minister Anthony Albanese, she spent much of the morning parrying political questions on the role played by its spending choices.

Article content

Article content

Article content

What she tried to make clear, however, is that one of Australia’s main inflation drivers is beyond her control at the central bank, even if it’s technically the RBA’s job to tame prices. There are also deeper causes than just Albanese’s fiscal choices.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The point, she said, is “the extent to which the economy is capacity constrained.”

Article content

That is, an economy like Australia’s facing supply and labor bottlenecks can only grow so fast without fueling inflation.

Article content

The RBA’s rate hike this week highlighted this challenge, which many developed economies now face. As governments push budgets deep into the red to finance support for aging populations, military upgrades and energy transitions, Australia offers a cautionary tale of how inflation drivers can often be beyond the reach of monetary policy.

Article content

The center-right opposition all week has hammered excessive spending as the reason Australia alone in the world is raising rates. At Bullock’s testimony, they asked whether she was reluctant to comment on fiscal policy because she’d been ordered not to by the Labor government.

Article content

Article content

The governor denied that she or the RBA board had faced political pressure.

Article content

Economic growth began picking up around the middle of last year. While government activity has eased in recent quarters, public spending remains historically high at nearly 27% of gross domestic product.

Article content

At the same time, there are signs of an upswing in the private sector, with most of it focused on artificial intelligence and energy infrastructure. The labor market remains tight as well, with unemployment hovering near a historically low level at 4.1%.

Article content

Adding further fuel to prices, an upturn in the global economy has boosted prospects for Australia, which is among the top suppliers of iron ore, coal, copper, gold and some critical minerals.

Article content

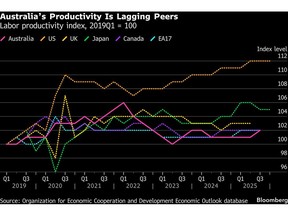

All that has refueled inflation in an economy that is struggling with some of the weakest productivity in the developed world. Indeed, Australia’s potential growth is so low now that, at 2%, it’s been reached early in the business cycle.

Article content

Inflation last quarter came in at 3.4%, overshooting the top of the RBA’s 2-3% target.

Article content

The government is due to release a budget in May, and pressure is mounting on it to rein in spending and tackle productivity-enhancing measures.

.jpg) 2 hours ago

3

2 hours ago

3

English (US)

English (US)