Article content

for the three months ended 30 June 2025

(figures are unaudited and in A$ except where stated)

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

TORONTO, July 29, 2025 (GLOBE NEWSWIRE) —

Article content

Article content

June 2025 Quarter

During the Quarter ending 30 June 2025 (June Quarter), Xanadu Mines Ltd (Xanadu or the Company) focused on strategic funding options to progress the Kharmagtai Copper and Gold Project (Kharmagtai). This resulted in an off-market takeover bid from Bastion Mining Pty Ltd (Bastion), which the Board recommended to shareholders. At the time of this report, Bastion has acquired a relevant interest exceeding 90% of Xanadu shares and issued a Notice of Compulsory Acquisition for all remaining shares outstanding1.

Article content

Article content

Key Highlights:

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

- Xanadu entered into an exclusivity period with Zijin Mining Group Co. Ltd. (Zijin) on 7 April 2025 to discuss a range of potential corporate transactions. The exclusivity period expired on 5 May 2025 without the finalisation of a control transaction.2,3

- Xanadu entered into a Bid Implementation Agreement (BIA) with Bastion on 19 May 2025, with the Board recommending an off-market takeover bid to acquire all full paid, ordinary shares in Xanadu at a price of A$0.08 cash per Xanadu Share (Offer).4

- The Offer represented a 57% premium to Xanadu’s closing price of A$0.051 per share on 16 May 2025 and a 52% premium to Xanadu’s 90-day Volume Weighted Average Price (VWAP) up to 16 May 2025.

- To provide interim funding, Bastion and Xanadu entered into a share subscription agreement, under which Bastion subscribed to 286,829,633 Xanadu shares at an issue price of A$0.06 per share, raising A$17.2 million.

- Xanadu withdrew on 26 May 2025 the shareholder resolutions to execute a put option under the Kharmagtai Joint Venture Shareholders Agreement with Zijin.5

- Bastion declared the takeover offer unconditional on 24 June, after reaching more than 50% shareholding in Xanadu.6 The Board reiterated its recommendation for shareholders to accept the offer as soon as practicable.7

- Xanadu held A$18.532 million in cash on 30 June 2025.

- Subsequent to the quarter, on 25 July 2025, Bastion published a Notice of Compulsory Acquisition, having acquired a relevant interest of greater than 90% of Xanadu shares.8

- Subsequent to the quarter, Bastion extended the Offer to close at 7:00pm (Sydney time) on 5 August 2025, unless further extended or withdrawn.9

- Subsequent to the quarter and following sale of Zijin shares into the Offer, Zijin’s nominee Shaoyang Shen resigned from the Board of Xanadu.10 Note that Zijin retains its 50% shareholding in the Khuiten Metals Pte Ltd, the entity which controls Kharmagtai.

Article content

Article content

Executive Chairman & Managing Director, Colin Moorhead, said:

“The transaction with Bastion is an important milestone on the journey for both the Kharmagtai Project and for Xanadu. This event also successfully concludes the company strategy to deliver a liquidity event for Xanadu shareholders to unlock value from the Kharmagtai discovery. Given the scale and complexity of the project, the challenging jurisdiction, and the added complexity of a 50:50 JV with a Chinese partner, I am very proud of this achievement and thank the team for their efforts, and shareholders for their support.

Article content

Looking forward, I expect Kharmagtai to be the next major mine to be built in Mongolia and an important producer of copper to the world. We wish Bastion and Zijin both success in moving this project rapidly to production.”

Article content

Corporate Transaction

On 7 April 2025, the Company undertook an exclusivity arrangement with its major shareholder and joint venture partner Zijin Mining Group Co. Ltd (Zijin), to allow the parties to discuss a range of potential corporate transactions11. This arrangement also extended the term of the potential option to allow the Company to dispose of a 25% interest in Khuiten Metals Pte Ltd (25% Put Option). Following substantive discussions with Zijin, on 5 May 2025 Xanadu reported that the parties had been unable to finalise a control transaction within the exclusivity period and that the Company would recommence discussions with other interested parties12. The 25% Put Option was subsequently withdrawn from the resolutions at the proposed Extraordinary General Meeting (EGM) scheduled for 4 June 2025 and the meeting was cancelled13.

Advertisement 1

Advertisement 2

Article content

On 19 May 2025, the Company announced that it had entered into a Bid Implementation Agreement with Bastion Mining Pte Ltd (Bastion) under which Bastion made an off-market takeover offer to acquire all the fully paid, ordinary shares issued in Xanadu (Xanadu Shares) which Bastion did not already own, at a price of A$0.08 cash per Xanadu Share (Offer) 14

15

16

17

18

19.

Article content

The Offer was made by Bastion, which represents a consortium of Boroo Pte Ltd (Boroo) and Xanadu Director Ganbayar Lkhagvasuren (together, the Bid Sponsors). Boroo is a private Singapore-incorporated entity which invests in major gold projects internationally. Boroo key assets include Lagunas Norte, a producing gold mine in Peru and a portfolio of development-stage projects in South America. Boroo has guaranteed Bastion’s obligations as bidder under the Bid Implementation Agreement.

Article content

In the Bastion Bidders Statement20, the bidder cited the significant premium to historic market prices for Xanadu shares and the substantial value of the offer at A$160 million for Xanadu Mines, at the high end of the valuation prepared by BDO. The Bidders Statement also noted the removal of exposure to risks associated to being invested in a Company with a non-operating minority join partner, and associated development risks.

Article content

Article content

Xanadu’s Takeover Board Committee21, together with Xanadu’s legal and financial advisers, carefully considered the Offer. The Takeover Board Committee Directors unanimously recommended that Xanadu shareholders ACCEPT the Offer in the absence of a superior proposal and subject to the Independent Expert concluding (and continuing to conclude) that the Offer is fair and reasonable.

Article content

The Board noted in its Target’s Statement22 that Bastion’s Offer has been made following the hard work and success of the Xanadu team in advancing the Kharmagtai Copper-Gold Project (Kharmagtai) over the last 5 years. The release of the Pre-Feasibility Study (PFS) in October 2024 and declaration of a maiden ore reserve was a significant milestone for the Company and confirmed the potential of Kharmagtai as a globally significant, long life, low cost and low risk future copper-gold mine.

Article content

As the next step for Xanadu, through its Bidder’s Statement, Bastion indicated an intent to delist Xanadu from both ASX and TSX exchanges should it reach a relevant interest of more than 75%. Bastion further indicated its intent to acquire all remaining shares in Xanadu via compulsory acquisition, should it reach an interest of more than 90%.

Article content

Article content

As the next phase for Kharmagtai is to secure the project’s permitting and Mongolian investment agreement pathway. In that regard, Boroo’s considerable in-country experience will be invaluable for driving the engagement process, making Bastion a natural choice as the new owner of Xanadu and partner to Zijin Mining Group Co. Ltd (Zijin). With Zijin now responsible for the operatorship of Kharmagtai and, recognising Xanadu’s profile as an exploration-focused company with limited balance sheet strength to fund its share of the very significant capital required to progress development of the project, the Takeover Board Committee noted that it considers that now is the appropriate time to provide a liquidity event for Xanadu Shareholders.

Article content

Subsequent to the quarter, Bastion gave notice that it had extended its Offer23 to now close at 7pm Sydney time on 5 August 2025 (unless further extended or withdrawn). The Takeover Board Committee reiterated its unanimous recommendation that Xanadu Shareholders ACCEPT the Offer as soon as practicable (in the absence of a superior proposal and subject to the Independent Expert continuing to conclude that the Offer is fair and reasonable). This recommendation outlined the potential risks to liquidity and value of shares held if the Offer closes and Bastion is not entitled to proceed to the compulsory acquisition.

Article content

On 25 July, Bastion announced that following acceptances of its Offer to date, it held relevant interest greater than 90% of Xanadu shares and issued a Notice of Compulsory Acquisition for the remaining shares outstanding24.

Article content

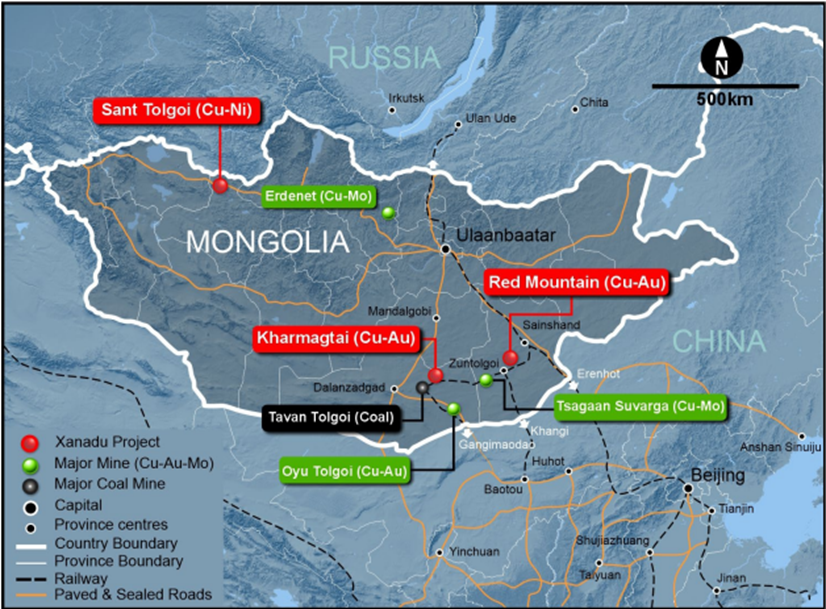

Operations

During the quarter, Xanadu maintained its three projects at operational care & maintenance status, which included Kharmagtai (operated by Zijin), the Red Mountain Copper-Gold Project, and the Sant Tolgoi Copper-Nickel Project. At Kharmagtai, technical discussions continued in preparation for the Bankable Feasibility Study (BFS), and both local community and regulatory engagement programs continued as planned. No exploration activity was undertaken during the quarter.

Article content

Article content

Figure 1: Location of Xanadu Projects in Mongolia

Article content

| Results of Operations | ||||||||

| Quarter Ended | ||||||||

| 30 Jun 2025 | 31 Mar 2025 | 31 Dec 2024 | 30 Sep 2024 | 30 Jun 2024 | ||||

| $’000 | $’000 | $’000 | $’000 | $’000 | ||||

| JV: Gross Exploration Expenditure a | ||||||||

| Kharmagtai | – | – | – | – | 4,209 | |||

| Drill metres b,c | – | – | – | – | 601 | |||

| Gross Exploration Expenditure | ||||||||

| Red Mountain | 23 | 30 | 42 | 97 | 929 | |||

| Drill metres b,c | – | – | – | – | 3,726 | |||

| Sant Tolgoi | 2 | 97 | 331 | 181 | – | |||

| Drill metres | – | – | – | – | – | |||

| Exploration expenditures capitalised d | 25 | 127 | 373 | 278 | 929 | |||

| Corporate general and administration e | 6,844 | 1,020 | 2,104 | 1,175 | 1,466 | |||

| Less JV Operator Overhead recovery f | ( – ) | ( – ) | ( – ) | (933) | (1,036) | |||

| Net Corporate general and administration | 6,844 | 1,020 | 2,104 | 242 | 430 | |||

Article content

Article content

| a. | Includes all forms of exploration such as diamond drilling, trenching, hydrology drilling, geophysics, assays and related costs. | |

| b. | Reflects invoiced metres paid during the quarter under drilling contract. Physical metres drilled during the quarter may vary due to invoice timing. | |

| c. | Excludes metres related to horizontal trenching, hydrological drilling, and shallow geotechnical investigation. | |

| d. | Excludes Kharmagtai (Khuiten JV) Gross exploration expenditure no longer consolidated in the Company’s results. | |

| e. | Includes expenses accrued for June Qtr for Jefferies fees of $3.6M and Bacchus Capital Advisors of $1M in relation to the takeover offer announced by Bastion. Includes tranche 1 of success fee of AUD$753k paid to Jeffries in April 2023 and following tranche 2 AUD$750 accrued Dec 2023, paid April 2024 in relation to completion of Khuiten JV with Zijin. | |

| f. | As operator of Khuiten JV, the operator overheads are recoverable in accordance with the Shareholders Joint Venture Agreement. |

Article content

Financial and Corporate

Article content

Capital Structure

On 30 June 2025, the Company had 2,291,211,189 fully paid ordinary shares on issue and approximately A$18.532 million in cash.

Article content

Article content

During the Quarter, the Company advised that 92,184,000 fully paid ordinary shares were issued to exercising option holders or their nominees following a Change of Control event which resulted in the waiving of all Vesting and Restriction conditions in accordance with the terms of the options issue25.

Article content

Equity Funding Arrangements

To assist Xanadu in meeting its corporate and joint venture funding obligations during the Offer period, Bastion and Xanadu entered into a share subscription agreement under which Bastion agreed to subscribe for 286,829,633 Xanadu Shares at an issue price of A$0.06 per share.26

Article content

The issue of the Subscription Shares took place on 26 May 2025 and were issued under Xanadu’s available placement capacity pursuant to ASX Listing Rule 7.1.27 Xanadu received a cash sum of A$17.2 million for the Subscription Shares; and immediately following settlement, Bastion held a relevant interest in 13.04% of Xanadu Shares.

Article content

Shareholder Meetings

An Extraordinary General Meeting (EGM) was scheduled for 11 April 2025 to vote on the exercise of the 25% put option in respect of Khuiten Metals Pte Ltd and to ratify prior issue of shares. The put option resolution was withdrawn after announcement of exclusivity arrangements with Zijin and extension of the put option exercise period.28

Article content

The Annual General Meeting (AGM) was held on 22 May 2025, with all resolutions approved by shareholders.29

Article content

A second EGM was scheduled for 4 June 2025 to vote on the 25% put option, after conclusion of the exclusivity period with Zijin. This resolution was withdrawn and the EGM was cancelled after completion of the equity placement to Bastion and commencement of the off-market takeover bid period.30

Article content

Director Resignation

Subsequent to the Quarter and following sale of Zijin shares into the Offer, Zijin’s nominee Shaoyang Shen resigned from the Board of Xanadu.31 Note that Zijin retains its 50% shareholding in the Khuiten Metals Pte Ltd, the entity which controls Kharmagtai.

Article content

ASX Announcements

This June 2025 Quarterly Activities Report does not contain any information reported in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore

Reserves (JORC Code, 2012).

Article content

About Xanadu Mines

Xanadu is an ASX and TSX listed Exploration company operating in Mongolia. We give investors exposure to globally significant, large-scale copper-gold discoveries and low-cost inventory growth. Xanadu maintains a portfolio of exploration projects and remains one of the few junior explorers on the ASX or TSX who jointly control a globally significant copper-gold deposit in our flagship Kharmagtai project.

Article content

Article content

For further information on Xanadu, please visit: www.xanadumines.com or contact:

Article content

| Colin Moorhead Executive Chairman & Managing Director | Spencer Cole Chief Financial & Development Officer |

Article content

This Announcement was authorised for release by Xanadu’s Board of Directors.

Article content

APPENDIX 1: STATEMENTS AND DISCLAIMERS

Article content

MINERAL RESOURCES AND ORE RESERVES REPORTING REQUIREMENTS

The JORC Code, 2012 sets out minimum standards, recommendations and guidelines for Public Reporting in Australasia of Exploration Results, Mineral Resources and Ore Reserves. The Information contained in this Announcement has been presented in accordance with the JORC Code, 2012.

Article content

MINERAL RESOURCES AND ORE RESERVES

Mineral Resource Estimates for Kharmagtai were updated during the September 2024 Quarter – please refer to the relevant ASX/TSX Announcement for details32 A Maiden Ore Reserve Estimate was reported in the same Announcement.

Article content

MINING ACTIVITIES

There were no mine production or development activities during the June 2025 Quarter.

Article content

Article content

LIST OF TENEMENTS

Xanadu held licenses for the following tenements during the June 2025 Quarter. No new farm-in or farm-out agreements were entered into during the quarter.

Article content

| Project Name | Tenement Name | Beneficial Ownership Start of Quarter | Beneficial Ownership End of Quarter | Location | ||

| Sant Tolgoi | Sant Tolgoi | 0% | 0%33,34 | Mongolia, Zavkhan Province | ||

| Red Mountain | Red Mountain | 100% | 100% | Mongolia, Dornogobi province, Saikhandulaan soum | ||

| Kharmagtai | Kharmagtai | 38.25%35 | 38.25% | Mongolia, Umnugobi province, Tsogttsetsii soum | ||

Article content

COMPETENT PERSON STATEMENTS

The information in this announcement that relates to Mineral Resources is based on information compiled by Mr Robert Spiers, who is responsible for the Mineral Resource Estimate. Mr Spiers is a full time Principal Geologist employed by Spiers Geological Consultants (SGC) and is a Member of the Australian Institute of Geoscientists. He has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity he is undertaking to qualify as the Qualified Person as defined in the CIM Guidelines and National Instrument 43-101 and as a Competent Person under JORC Code, 2012. Mr Spiers consents to the inclusion in the report of the matters based on this information in the form and context in which it appears.

Article content

The information in this announcement that relates to exploration results is based on information compiled by Dr Andrew Stewart, who is responsible for the exploration data, comments on exploration target sizes, QA/QC and geological interpretation and information. Australasian Institute of Geoscientists and is a Member of the Australasian Institute of Geoscientists, has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity he is undertaking to qualify as the Competent Person as defined in the JORC Code, 2012 and the National Instrument 43-101. Dr Stewart consents to the inclusion in the report of the matters based on this information in the form and context in which it appears.

Article content

RELATED PARTIES

As set out in section 6.1 of the attached Appendix 5B, Mining exploration entity or oil and gas exploration entity quarterly cash flow report, payments made to related parties and their associates was approx. $844,173 in the June 2025 Quarter. The amounts relate to salary, superannuation and bonus payments to Directors; legal fees paid to HopgoodGanim Lawyers (a company associated with Xanadu Non-Executive Director Michele Muscillo) for legal services including support to the merger & acquisition activity; rent paid to Xanadu Executive Director Ganbayar Lkhagvasuren in relation to Xanadu’s Ulaanbaatar office; and rent fees paid to Colin Moorhead & Associates (a company associated with Xanadu’s Executive Chairman and Managing Director, Colin Moorhead) in relation to a share of Xanadu’s Melbourne office.

Article content

Article content

COPPER EQUIVALENT CALCULATIONS

The copper equivalent (eCu, CuEq) calculation represents the total metal value for each metal, multiplied by the conversion factor, summed and expressed in equivalent copper percentage with a metallurgical recovery factor applied.

Article content

Copper equivalent grade values were calculated using the formula: CuEq = Cu + Au * 0.60049 * 0.86667.

Article content

Where Cu – copper grade (%); Au – gold grade (g/t); 0.60049 – conversion factor (gold to copper); 0.86667 – relative recovery of gold to copper (86.67%).

Article content

The copper equivalent formula was based on the following parameters (prices are in USD): Copper price 3.4 $/lb; Gold price 1400 $/oz; Copper recovery 90%; Gold recovery 78%; Relative recovery of gold to copper = 78% / 90% = 86.67%.

Article content

FORWARD‐LOOKING STATEMENTS

Certain statements contained in this Announcement, including information as to the future financial or operating performance of Xanadu and its projects may also include statements which are ‘forward‐looking statements’ that may include, amongst other things, statements regarding targets, estimates and assumptions in respect of mineral reserves and mineral resources and anticipated grades and recovery rates, production and prices, recovery costs and results, capital expenditures and are or may be based on assumptions and estimates related to future technical, economic, market, political, social and other conditions. These ‘forward-looking statements’ are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Xanadu, are inherently subject to significant technical, business, economic, competitive, political and social uncertainties and contingencies and involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from estimated or anticipated events or results reflected in such forward‐looking statements.

Article content

Article content

Xanadu disclaims any intent or obligation to update publicly or release any revisions to any forward‐looking statements, whether a result of new information, future events, circumstances or results or otherwise after the date of this Announcement or to reflect the occurrence of unanticipated events, other than required by the Corporations Act 2001 (Cth) and the Listing Rules of the Australian Securities Exchange (ASX) and Toronto Stock Exchange (TSX). The words ‘believe’, ‘expect’, ‘anticipate’, ‘indicate’, ‘contemplate’, ‘target’, ‘plan’, ‘intends’, ‘continue’, ‘budget’, ‘estimate’, ‘may’, ‘will’, ‘schedule’ and similar expressions identify forward‐looking statements.

Article content

All ‘forward‐looking statements’ made in this Announcement are qualified by the foregoing cautionary statements. Investors are cautioned that ‘forward‐looking statements’ are not guarantee of future performance and accordingly investors are cautioned not to put undue reliance on ‘forward‐looking statements’ due to the inherent uncertainty therein.

Article content

For further information, please visit the Xanadu Mines web site www.xanadumines.com.

Article content

Appendix 5B

Article content

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

Article content

| Name of entity | ||

| Xanadu Mines Ltd | ||

| ABN | Quarter ended (“current quarter”) | |

| 92 114 249 026 | 30 June 2025 | |

Article content

| Consolidated statement of cash flows | Current quarter $A’000 | Year to date (6 months) $A’000 | |

| 1. | Cash flows from operating activities | – | – |

| 1.1 | Receipts from customers | ||

| 1.2 | Payments for | – | – |

| (a) exploration & evaluation | |||

| (b) development | – | – | |

| (c) production | – | – | |

| (d) staff costs | (1,045) | (1,893) | |

| (e) administration and corporate costs | (1,373) | (2,355) | |

| 1.3 | Dividends received (see note 3) | – | – |

| 1.4 | Interest received | 63 | 91 |

| 1.5 | Interest and other costs of finance paid | (5) | (15) |

| 1.6 | Income taxes paid | – | – |

| 1.7 | Government grants and tax incentives | – | – |

| 1.8 | Other (provide details if material) | – | – |

| 1.9 | Net cash from / (used in) operating activities | (2,321) | (4,133) |

| 2. | Cash flows from investing activities | – | – |

| 2.1 | Payments to acquire or for: | ||

| (a) entities | |||

| (b) tenements | – | – | |

| (c) property, plant and equipment | (39) | (39) | |

| (d) exploration & evaluation | (26) | (153) | |

| (e) investments – Khuiten JV Share Subscription | – | (1,689) | |

| (f) other non-current assets | – | – | |

| 2.2 | Proceeds from the disposal of: | – | – |

| (a) entities | |||

| (b) tenements | – | – | |

| (c) property, plant and equipment | – | – | |

| (d) investments | – | – | |

| (e) other non-current assets | – | – | |

| 2.3 | Cash flows from loans to other entities | – | – |

| 2.4 | Dividends received (see note 3) | – | – |

| 2.5 | Other (provide details if material) Loans to Khuiten Metals Joint Venture | – | (251) |

| 2.6 | Net cash from / (used in) investing activities | (65) | (2,132) |

| 3. | Cash flows from financing activities | 17,210 | 18,668 |

| 3.1 | Proceeds from issues of equity securities (excluding convertible debt securities) | ||

| 3.2 | Proceeds from issue of convertible debt securities | – | – |

| 3.3 | Proceeds from exercise of options | – | – |

| 3.4 | Transaction costs related to issues of equity securities or convertible debt securities | – | – |

| 3.5 | Proceeds from borrowings | – | – |

| 3.6 | Repayment of borrowings | (18) | (33) |

| 3.7 | Transaction costs related to loans and borrowings | – | – |

| 3.8 | Dividends paid | – | – |

| 3.9 | Other (provide details if material) | – | – |

| 3.10 | Net cash from / (used in) financing activities | 17,192 | 18,635 |

| 4. | Net increase / (decrease) in cash and cash equivalents for the period | ||

| 4.1 | Cash and cash equivalents at beginning of period | 3,726 | 6,162 |

| 4.2 | Net cash from / (used in) operating activities (item 1.9 above) | (2,360) | (4,172) |

| 4.3 | Net cash from / (used in) investing activities (item 2.6 above) | (26) | (2,093) |

| 4.4 | Net cash from / (used in) financing activities (item 3.10 above) | 17,192 | 18,635 |

| 4.5 | Effect of movement in exchange rates on cash held | 0 | 0 |

| 4.6 | Cash and cash equivalents at end of period | 18,532 | 18,532 |

Article content

Article content

| 5. | Reconciliation of cash and cash equivalents at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts | Current quarter $A’000 | Previous quarter $A’000 |

| 5.1 | Bank balances | 6,532 | 1,726 |

| 5.2 | Call deposits | 12,000 | 2,000 |

| 5.3 | Bank overdrafts | – | – |

| 5.4 | Other (provide details) | – | – |

| 5.5 | Cash and cash equivalents at end of quarter (should equal item 4.6 above) | 18,532 | 3,726 |

Article content

| 6. | Payments to related parties of the entity and their associates | Current quarter $A’000 |

| 6.1 | Aggregate amount of payments to related parties and their associates included in item 1 | 844 |

| 6.2 | Aggregate amount of payments to related parties and their associates included in item 2 | – |

| Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments. | ||

Article content

| 7. | Financing facilities Note: the term “facility’ includes all forms of financing arrangements available to the entity. Add notes as necessary for an understanding of the sources of finance available to the entity. | Total facility amount at quarter end $A’000 | Amount drawn at quarter end $A’000 |

| 7.1 | Loan facilities | – | – |

| 7.2 | Credit standby arrangements | – | – |

| 7.3 | Other (please specify) Motor vehicles leases Mongolia | 219 | 219 |

| 7.4 | Total financing facilities | 219 | 219 |

| 7.5 | Unused financing facilities available at quarter end | – | |

| 7.6 | Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well. | ||

| NA | |||

Article content

Article content

| 8. | Estimated cash available for future operating activities | $A’000 | |

| 8.1 | Net cash from / (used in) operating activities (item 1.9) | (2,321 | ) |

| 8.2 | (Payments for exploration & evaluation classified as investing activities) (item 2.1(d)) | (26 | ) |

| 8.3 | Total relevant outgoings (item 8.1 + item 8.2) | (2,347 | ) |

| 8.4 | Cash and cash equivalents at quarter end (item 4.6) | 18,532 | |

| 8.5 | Unused finance facilities available at quarter end (item 7.5) | – | |

| 8.6 | Total available funding (item 8.4 + item 8.5) | 18,532 | |

| 8.7 | Estimated quarters of funding available (item 8.6 divided by item 8.3) | 7.90 | |

| Note: if the entity has reported positive relevant outgoings (ie a net cash inflow) in item 8.3, answer item 8.7 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.7. | |||

| 8.8 | If item 8.7 is less than 2 quarters, please provide answers to the following questions: | ||

| 8.8.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? | |||

| Answer: NA | |||

| 8.8.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? | |||

| Answer: NA | |||

| 8.8.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? | |||

| Answer: NA | |||

| Note: where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above must be answered. | |||

Article content

Compliance statement

Article content

1 This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

Article content

2 This statement gives a true and fair view of the matters disclosed.

Article content

Date: 29 July 2025

Article content

Authorised by the Board

Article content

(Name of body or officer authorising release – see note 4)

Article content

| Notes | ||

| 1. | This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so. | |

| 2. | If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report. | |

| 3. | Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity. | |

| 4. | If this report has been authorised for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorised for release to the market by a committee of your board of directors, you can insert here: “By the [name of board committee – e.g. Audit and Risk Committee]”. If it has been authorised for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”. | |

| 5. | If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively. | |

Article content

Article content

1 ASX/TSX Announcement 25 July 2025 – Notice of Compulsory Acquisition

2 ASX/TSX Announcement 7 April 2025 – EGM Update, Exclusivity Arrangements with Zijin

3 ASX/TSX Announcement 5 May 2025 – Update to Zijin Put Option and Exclusivity Arrangements

4 ASX/TSX Announcement 19 May 2025 – Recommended A$0.08 Per Share Cash Offer

5 ASX/TSX Announcement 26 May 2025 – Withdrawal of Put Option and Cancellation of EGM

6 ASX/TSX Announcement 24 June 2025 – Takeover Offer for Xanadu Declared Unconditional

7 ASX/TSX Announcement 8 July 2025 – Acceptance Update

8 ASX/TSX Announcement 25 July 2025 – Notice of Compulsory Acquisition

9 ASX/TSX Announcement 24 July 2025 – Takeover Offer for Xanadu – Extension of the Offer Period

10 ASX/TSX Announcement 11 July 2025 – Non-Executive Director Resignation Shaoyang Shen

11 ASX/TSX Announcement 7 April 2025 – EGM Update – Exclusivity Arrangements with Zijin

12 ASX/TSX Announcement 5 May 2025 – Update to Zijin Put Option and Exclusivity Arrangements

13 ASX/TSX Announcement 26 May 2025 – Withdrawal of Put Option Resolution and Cancellation of EGM

14 ASX/TSX Announcement 19 May 2025 – Recommended A$0.08 Per Share Cash Offer

15 ASX/TSX Announcement 27 May 2025 – Bidder’s Statement – Bastion Mining Pte Ltd

16 ASX/TSX Announcement 27 May 2025 – Target’s Statement – Accept Bastion Takeover Offer

17 ASX/TSX Announcement 17 June 2025 – Material Update on Off-Market Takeover Offer – Acceptance by Zijin Mining Group

18 ASX/TSX Announcement 24 June 2025 – Takeover Offer for Xanadu declared Unconditional

19 ASX/TSX Announcement 24 June 2025 – Supplementary Target’s Statement

20 ASX/TSX Announcement 27 May 2025 – Bidder’s Statement – Bstion Mining Pte Ltd

21 The Takeover Board Committee comprises all Xanadu Directors as at the date of this announcement other than Ganbayar Lkhagvasuren and Zijin’s representative, Shaoyang Shen.

22 ASX/TSX Announcement 27 May 2025 – Target’s Statement – Accept Bastion Takeover Offer

23 ASX/TSX Announcement 24 July 2025 – Takeover Offer for Xanadu – Extension of the Offer Period

24 ASX/TSX Announcement 25 July 2025 – Notice of Compulsory Acquisition

25 ASX/TSX Announcement 20 May 2025 – Cleansing Notice

26 ASX/TSX Announcement 19 May 2025 – Recommended A$0.08 per share cash offer

27 ASX/TSX Announcement 26 May 2025 – Application for Quotation of Securities

28 ASX/TSX Announcement 7 April 2025 – Update on Extraordinary General Meeting – Extension of Zijin Put Option and Exclusivity Arrangements

29 ASX/TSX Announcement 22 May 2025 – Results of Annual General Meeting

30 ASX/TSX Announcement 26 May 2025 – Withdrawal of Put Option Resolution and Cancellation of EGM

31 ASX/TSX Announcement 11 July 2025 – Non-Executive Director Resignation Shaoyang Shen

32 ASX/TSX Announcement 14 October 2024 – Kharmagtai Maiden Ore Reserve, Updated Mineral Resource

33 Currently earning into 51% equity in Sant Tolgoi project by spending US$1M over 24 months commencing 22 January 2024

34 ASX/TSX Announcement 22 January 2024 – Xanadu Enters into New Magmatic Copper and Nickel Sulphide Project

35 38.25% represents 50% of Khuiten Metals via the Khuiten JV with Zijin. Khuiten Metals controls Kharmagtai and holds 76.5% of the Kharmagtai mining lease.

Article content

Article content

Article content

Article content

Article content

Article content

Article content

Article content

.jpg) 19 hours ago

1

19 hours ago

1

English (US)

English (US)