Article content

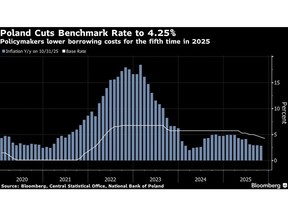

(Bloomberg) — Poland’s central bank cut interest rates to the lowest level in three-and-a-half years as a surprise decline in inflation outweighed concerns over loose government spending.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The fifth reduction this year on Wednesday took the benchmark 25 basis points lower to 4.25%. The decision was expected by most economists surveyed by Bloomberg and came just days after inflation data for September showed price growth easing to 2.8%, defying predictions for a slight acceleration.

Article content

Article content

Article content

Some policymakers have been signaling ahead of the meeting that they may pause the recent series of cuts with the government running the European Union’s second-widest budget deficit. The economy is on track to expand more than 3% both this year and next, although the unemployment rate has climbed to the highest level since early 2023.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

In total, the Polish panel has reduced rates by 150 basis points this year, compared with 50 basis points of easing in the Czech Republic and no changes in Hungary. Nevertheless, all three major eastern European economies continue to have positive real rates, meaning that their benchmarks are higher than headline inflation.

Article content

Nicholas Farr, emerging Europe economist at Capital Economics, said Poland’s easing cycle doesn’t have much further to go. He expects one further quarter-point cut, most likely early next year, “before an extended pause.”

Article content

Polish inflation is well within the MPC’s tolerance range for price growth. The quarter-point cut was expected by 24 out of 31 economists surveyed by Bloomberg. The remainder predicted no change. Central Bank Governor Adam Glapinski holds a news conference on Thursday.

Article content

Article content

The zloty traded 0.2% stronger against the euro on Wednesday, while Warsaw’s WIG20 stock index was little changed.

Article content

Since the Polish panel last met in October, several policymakers, including Ludwik Kotecki, Cezary Kochalski and Gabriela Maslowska, urged caution with additional cuts due to concerns that inflation may rebound, mostly driven by loose fiscal policy.

Article content

Prime Minister Donald Tusk’s government is running the European Union’s second-widest budget deficit with no plans to substantially narrow it before an election due in 2027. Both Moody’s Ratings and Fitch Ratings cut their outlooks on Poland’s credit grade, citing the shortfall and fast-growing debt, while S&P is set to publish its review on Friday.

Article content

Policymakers have for months agonized over risks from price stability coming from energy prices, helping push the government to extend a cap on power prices for households until the end of 2025. The decision effectively reduced the path of inflation and has allowed the central bank to continue with their gradual rate reductions.

Article content

Economists at ING Bank Slaski SA said they expect inflation to reach the policymakers’ 2.5% target this year and remain near that level in 2026.

Article content

—With assistance from Barbara Sladkowska, Peter Laca and Andras Gergely.

Article content

(Updates with comments from economists, details from the first paragraph.)

Article content

.jpg) 2 hours ago

1

2 hours ago

1

English (US)

English (US)