Article content

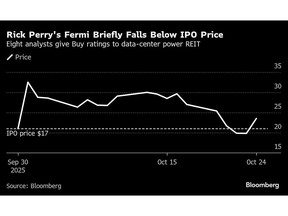

(Bloomberg) — Fermi Inc. shares fluctuated after Wall Street analysts unanimously awarded Buy ratings for the stock, countering skepticism over whether the Texas-based power developer can make good on its ambitions to become a hub fueling America’s artificial intelligence boom.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Eight analysts launched coverage Monday, almost a month after it raised $784.9 million in a US IPO, with an average 12-month price target of $31.63 per share. The bullish view on the unprofitable real estate investment trust is driven by analysts’ forecasts that the firm can leverage its land lease from Texas Tech University and produce large amounts of power to meet surging demand from AI data centers.

Article content

Article content

Article content

Shares struggled for direction on Monday, erasing earlier losses to climb 1.2% to $23.82 each as of 2:29 p.m. The stock briefly fell below its IPO price of $21 per share last week before recovering.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The endorsements come despite concern over Fermi’s track record of less than a year, as well as its lack of revenue and only one non-binding agreement with a prospective tenant. Still, with President Donald Trump’s administration pushing regulators to accelerate grid-connection approvals for the data center industry, and demand for electricity from the largest cloud and AI companies, including Amazon.com Inc. and Microsoft Corp. soaring, analysts pointed to the deep energy experience and political ties of Fermi’s management team which could speed project approvals.

Article content

They include co-founders Rick Perry, US Energy Secretary in Trump’s first term, and Toby Neugebauer, Fermi’s chief executive officer and co-founder of private equity firm Quantum Energy Partners.

Article content

“We consider the management team well-rounded and execution-driven, with deep experience in power generation, nuclear build and finance — plus political connections that could help accelerate development,” Mizuho analyst Vikram Malhotra wrote in a note.

Article content

Article content

The company is developing Project Matador, an energy and data-center campus with more than 5,000 acres of land, and which plans to deliver as much as 11 gigawatts of low-carbon power by 2038, starting with one gigawatt in 2026. Analysts cited Fermi’s strategic location and grid access as major advantages.

Article content

“There’s no other landlord in the US today that can deliver this amount of power for data centers this quickly and at scale,” Malhotra said in an interview. He initiated coverage with a $27 price target, implying roughly 15% upside from Friday’s close.

Article content

Malhotra also highlighted Fermi’s dual-role model as a key advantage: a landlord and a power generating company, referring to its plans to develop a nuclear plant. He forecasts that initial revenue could phase in during 2026, with full revenue of about $2 billion for the first gigawatt expected in 2027. If successful, Fermi’s campus would become the largest data-center power hub in the US, he added.

Article content

Fermi has signed a non-binding letter of intent for its first lease, its IPO prospectus showed, and analysts expect more to sign up.

.jpg) 2 hours ago

2

2 hours ago

2

English (US)

English (US)