Article content

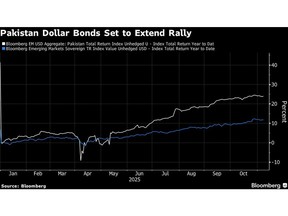

(Bloomberg) — Pakistan’s dollar bonds will likely extend their rally as credit-rating upgrades and the government’s plans to re-enter global debt markets bolster sentiment, according to investors.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The nation plans to sell yuan-denominated bonds later this year and return to the Eurobond market in 2026 for the first time in nearly five years, marking a pivotal moment for a country that came close to a default two years ago. The move could fuel further gains in its debt, according to Goldman Sachs Asset Management and UBS Asset Management.

Article content

Article content

Article content

The issuance plans underscore Pakistan’s push to broaden its funding sources and reduce dependence on the International Monetary Fund. Its dollar bonds have gained 24.5% this year, outperforming peers with similar credit ratings such as Egypt and Argentina.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Danske Bank Asset Management, which bought Pakistan’s dollar bonds at the height of its financial crisis two years ago, has added to its holdings several times this year, said Søren Mørch, head of emerging markets debt. “We are optimistic that Pakistan will stay on the reform course, rebuilding buffers like higher dollar reserves and also getting market access and taking advantage of that,” he said.

Article content

S&P Global Ratings and Fitch Ratings upgraded the nation’s ratings this year, citing improved fiscal management and reform momentum under Prime Minister Shehbaz Sharif’s IMF-backed programs. The government has secured billions in IMF funding by raising taxes and maintaining fiscal discipline.

Article content

“The outperformance will sustain as long as they’re sticking to the IMF policies, which we believe they have a strong commitment to do so,” said Shamaila Khan, head of fixed income emerging markets & Asia Pacific at UBS Asset Management.

Article content

Article content

Market access possibly opening for Pakistan is another positive, because “then you really are not concerned about refinancing over the next two to three years,” she added.

Article content

Still, tensions with neighbors India and Afghanistan pose risks to its already sluggish economic growth, while a rise in energy prices could strain finances given that oil accounts for about 30% of total imports.

Article content

For now, investors remain upbeat. “In the next six to 12 months, we see rating upgrades as the first catalyst and market access as the next catalyst” for capital appreciation in markets like Pakistan, said Salman Niaz, head of global fixed income for APAC ex-Japan at Goldman Sachs Asset Management.

Article content

—With assistance from Faseeh Mangi.

Article content

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)