Article content

Many countries, including Canada, have used debt to GDP as a fiscal anchor — a rule or guardrail intended to keep a government from letting spending get out of control.

Article content

Canada’s federal debt-to-GDP ratio peaked in 1996 at 67 per cent before the Chretien-era reforms, but for the most part has been on the decline since then.

Article content

The PBO, however, issued a stark warning in September, telling a committee of Parliamentarians that Canada’s fiscal situation was “unsustainable” and warned the debt-to-GDP ratio is expected to remain above 43 per cent over the medium-term.

Article content

Private sector forecasts have been similar.

Article content

The Royal Bank of Canada projects Canada’s federal debt-to-GDP will hit 42.2 per cent in 2025-2026 and will remain above 42 per cent until 2030, where it will fall to 41.9 per cent.

Article content

While Trudeau had committed to reduce the debt-to-GDP ratio as a fiscal anchor in Budget 2024, current Finance Minister François-Philippe Champagne and Carney have made no such assurance, with Champagne only vowing that deficit-to-GDP ratio will decline over the medium term.

Article content

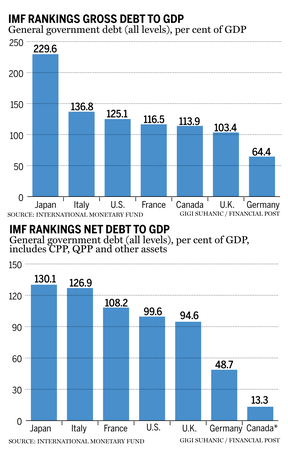

The federal government has often touted Canada’s net debt-to-GDP position as standing out among its G7 peers, it depends in part on how you measure it.

Article content

Article content

The IMF’s calculation of net-general-debt-to-GDP, for example, puts Canada at 13.3 per cent, by far the best in the G7.

Article content

However, this way of measuring Canada’s debt position subtracts the pension fund assets such as CPP and QPP from gross debt.

Article content

Canada’s gross general debt-to-GDP, which includes other levels of government, stood at 113.9 per cent according to the IMF, which still puts Canada among the lowest in the G7, but presents a much more alarming debt position.

Article content

Article content

Is Canada’s debt sustainable?

Article content

There is a general consensus among analysts that Canada’s fiscal credibility remains strong, with the country holding strong credit ratings including AAA from S&P, Aaa from Moody’s and AA+ from Fitch, but there are risks entering the picture.

Article content

In July, Fitch reaffirmed Canada’s credit rating based on Canada’s “strong governance, high per-capita income and a macroeconomic policy framework that has delivered steady growth and low inflation.”

Article content

However, Fitch warned of factors that could lead to a downgrade, including a “macroeconomic shock” brought on by the trade war and a “material rise in the general government debt/GDP ratio in the medium term, for example from a marked widening in the budget deficit or weakening in GDP growth.”

Article content

Article content

In a recent survey conducted by the Business Council of Canada, experts and business executives backed Carney’s plans to invest in the economy.

Article content

However, they also warned that while Canada’s fiscal credibility remains strong, its fiscal discipline has eroded since the 1990s and 2000s. They recommended the federal government commit to a deficit reduction target, a declining debt-to-GDP ratio and declining debt-servicing ratio in the upcoming budget.

Article content

The PBO issued a stark warning in September, telling a committee of Parliamentarians that Canada’s fiscal situation was “unsustainable” and warned the debt-to-GDP ratio is expected to remain above 43 per cent from 2026 to 2031, with no declining trend.

Article content

Article content

What about debt at other levels of government?

Article content

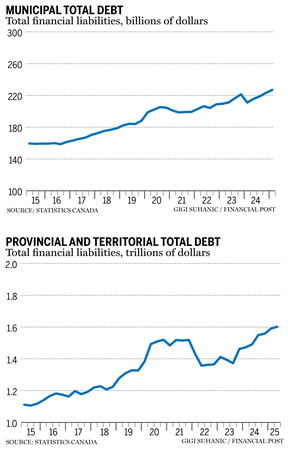

While the focus is often on the federal government, Canada’s territorial, provincial and local governments carry substantial debt burdens too.

Article content

Statistics Canada’s measure of the total liabilities of territorial, provincial and local governments rose to $1.487 trillion in 2023, a 4.3 per-cent increase from the year before.

.jpg) 4 hours ago

3

4 hours ago

3

English (US)

English (US)