Article content

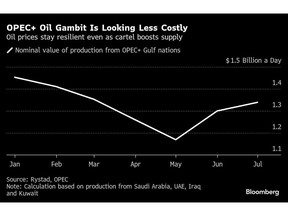

(Bloomberg) — The financial sting of OPEC+’s shock move to open the oil taps appears to be fading — for the time being.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

When Saudi Arabia and its partners agreed four months ago to rapidly revive crude production, the fallout seemed catastrophic: prices crashed to a four-year low, leaving producers with widening budget deficits as state revenues dwindled.

Article content

Article content

But the ensuing months, which saw the Organization of the Petroleum Exporting Countries and its partners announce further supply increases, have brought some solace.

Article content

Article content

As benchmark Brent recovers to $70 a barrel and the countries’ production targets rise, the nominal value of output from four of OPEC’s key Middle East members has climbed to the highest since February. This month it jumped to almost $1.4 billion per day, according to calculations using data from Rystad Energy A/S.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The main uncertainty, however, is whether this tentative rebound will endure.

Article content

Oil forecasters at Goldman Sachs Group Inc. and JPMorgan Chase & Co. widely expect a price slump later this year as extra barrels from OPEC+ swell the surplus created by faltering Chinese demand and brimming US supply. That could slash OPEC+ revenues again, and even pressure the coalition to roll back the latest output hikes.

Article content

Eight key OPEC+ nations will decide this weekend on another bumper production hike for September, which would complete the restart of a 2.2 million-barrel supply tranche a year ahead of schedule.

Article content

The alliance is still raking in less cash than before it loosened the spigot, and could face a deeper slump in the months ahead. But for now Riyadh can take consolation that the hit from pushing through such a bold strategy wasn’t much worse.

Article content

.jpg) 13 hours ago

1

13 hours ago

1

English (US)

English (US)