Article content

There’s lots for investors to chew on this week including where analysts think streaming juggernaut Netflix is headed after posting strong stock price and earnings growth so far this year. We also share the Top 3 stock picks from one RBC Capital Markets analyst, look at some high flying drone stocks and consider if dividend-paying stocks could be back in style.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

Stock of the week: Netflix Inc.

Article content

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Shares of Netflix Inc. (NFLX) are up 41 per cent this year, though the streaming giant’s stock took a short intermission on Friday, falling five per cent after reporting earnings that beat estimates, as the company failed to meet steep expectations. The stock is down 10 per cent from its all-time high on June 30. Regardless, analysts lined up to raise their price targets on the shares, which are currently trading around US$1,215. UBS Group AG, Morgan Stanley & Co. and JPMorgan Chase and Co. all hiked their price targets, with UBS citing “solid momentum” based on the earnings outlook. Bank of America Corp., which put a price target of US$1,490 on the shares, said Netflix has “growth drivers that should prove to be defensive.”

Article content

3 ideas for investors

Article content

RBC Capital Markets has three ideas for investors: Brookfield Corp. (BN), Element Fleet Management Corp. (EFN) and Fairfax Financial Holdings Ltd. (FFH). Brookfield is the top idea of analyst Bart Dziarski who describes it as a “core holding driven by its long-term track record of compounding capital.” The stock is trading around $93 making for a “good entry point,” Dziarski said. Element is his top growth pick and he is forecasting double-digit gains in earnings per share and return on equity, “underpinned by a lower-risk business model with a sticky client base.” It is trading at $35.46. Fairfax is Dziarski’s value pick. He argues that it is undervalued compared to peers. “Fairfax’s investment portfolio has been re-positioned to take advantage of the current interest rate environment driving improving investment results, which we expect to continue,” he said. It is trading at $2,420.09. Dziarski has price targets of $111.07 on Brookfield, $43 on Element and $2,811.37 on Fairfax.

Article content

Article content

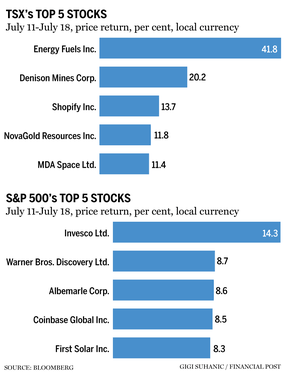

Keeping score

Article content

Article content

Article content

Article content

High-flying drone stocks

Article content

Is the sky the limit for drone stocks? The fly zone appears to have opened up after U.S. defence secretary Pete Hegseth last week announced a major policy shift regarding the manufacturing and use of drones emphasizing a buy-American philosophy in a statement made on the lawn of Pentagon with drones of all shapes and sizes hovering in the background. Following Hegseth’s announcement on July 10, drone stocks jumped across the board and continued their runs this week. Among the notable gainers, ZenaTech Inc. (ZENA) is up nearly 100 per cent to US$6.35 from US$3.28 last week while Kratos Defense & Security Solutions Inc. (KTOS), which has the largest market capitalization in the sector at US$9.9 billion, is up 27 per cent. For investors looking to get into the drone space, some other U.S.-listed options include AgEagle Aerial Systems Inc. (UAVS), Red Cat Holdings Inc. (RCAT) and Unusual Machines Inc. (UMAC).

Article content

Dividends back in the spotlight

Article content

Dividend-paying stocks could be back in style, especially if U.S. interest rates are eventually cut, bond yield fall and equity momentum slows. “Given the current policy uncertainty, economic slowdown, and the prospect of monetary easing, we continue to favour holding quality dividend-paying stocks,” Mehmet Beceren, a research economist and market strategist at Rosenberg Research and Associates Inc., said in a note. Beceren acknowledged that over the longer-term, dividend-paying stocks historically have returned less than growth stocks in the U.S. Studies that show stronger returns typically assume that dividends will be reinvested, but Beceren said that assumption defeats the usual purpose of dividends, which is to provide income. So what makes for a “quality” dividend stock? Beceren warns not to jump at the highest yields out there as they can come with risks. Stocks may appear attractive because they are distressed or fundamentally weak,” he said, adding that many dividend exchange-traded funds (ETFs) now come with quality screens for profitability, leverage and volatility to avoid such a trap. Companies that consistently hike their dividend and undertake share buybacks are signs of improving profitability.

.jpg) 3 hours ago

1

3 hours ago

1

English (US)

English (US)