Article content

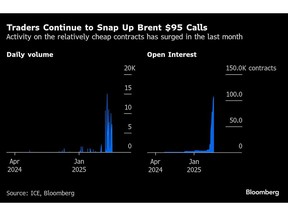

(Bloomberg) — Oil traders are continuing to ramp up long-shot options bets that Brent crude can rally toward $95 a barrel over the coming months.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

Call options at that strike price which expire in late July have traded more than 100,000 lots since the middle of April, with open interest growing by about the same amount. It’s the equivalent of 100 million barrels, and another 5,000 contracts were bought Monday.

Article content

Article content

Brent futures have rebounded from a four-year low reached in early April, and are continuing to climb after a trade detente between the US and China was agreed at talks over the weekend. The Trump administration is also ramping up sanctions on Iran and Venezuela, even as it engages in talks over the former’s nuclear program, running the risk of wider supply disruptions.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

At about 19 cents each, the options represent a relatively cheap bet on — or protection from — a further rally.

Article content

“Speculators want to have calls on the books,” in case tariffs are further dialed back or OPEC+ walks back production hikes, said Robert Yawger, director of the energy futures division at Mizuho Securities USA. “Plus, there is a chance the negotiations with Iran run their course with no agreement and Trump allows the Israelis to attack Iran. All unlikely, but all possible.”

Article content

Despite the rally, September crude futures are still trading around $65 a barrel, some $30 below that level. Prices have been under pressure as the Organization of the Petroleum Exporting Countries and its allies ramp up production at a faster rate than previously advertised. Alongside that, the US and China still retain some tariffs which have pushed analysts to slash their forecasts for economic growth.

Article content

Options markets have turned less bearish as crude has recovered. The premium for puts over calls, which at the end of April was the widest in more than three years, has shrunk by more than half, according to data compiled by Bloomberg.

Article content

Advertisement 1

.jpg) 6 hours ago

1

6 hours ago

1

English (US)

English (US)