Article content

(Bloomberg) — Oil fluctuated as the market remained on alert for whether President Donald Trump will plunge the US into the conflict between Israel and Iran.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

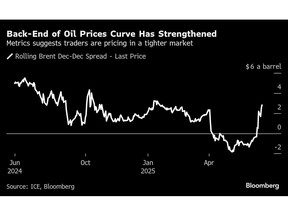

Brent traded near $77 a barrel after a slight uptick on Wednesday. Oil prices are markedly higher than where they were before the attacks began, with volatility spiking, options getting more bullish and premiums for nearby crude prices soaring over later ones.

Article content

Article content

Article content

Senior US officials are preparing for the possibility of a strike on Iran in the coming days, but the situation is still evolving and could change, according to people familiar with the matter. Trump concluded a meeting Wednesday with top advisers, but the White House offered few clues about the path forward.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Asked during the day if he was moving closer to bombing Iran, Trump said “I may do it. I may not do it.” The Wall Street Journal reported that the president approved a military attack plan earlier in the week, but withheld the final authorization as he weighed whether Tehran would meet his demands.

Article content

The biggest concern for the oil market centers on the Strait of Hormuz, but so far there are no signs that Tehran is seeking to disrupt shipping through the narrow waterway at the entrance to the Persian Gulf. About a fifth of the world’s crude output passes through the strait.

Article content

“We don’t see it as a likely scenario at this time, but given the precarious state that the Iran regime is in right now, I think everybody should be watching” the waterway, Mike Sommers, the president of the American Petroleum Institute, said in a Bloomberg television interview.

Article content

Article content

Goldman Sachs Group Inc. sees a geopolitical risk premium of around $10 a barrel for Brent due to the conflict, according to a note from analysts including Daan Struyven. However, the bank said its base-case scenario was oil falling to $60 in the fourth quarter, assuming there are no supply disruptions.

Article content

Shell Plc warned Thursady that any blocking of Hormuz would have a huge impact on global trade. The company has contingency plans in place in the event that things deteriorate, Chief Executive Officer Wael Sawan said at the Japan Energy Summit & Exhibition in Tokyo.

Article content

“Intraday volatility remains high,” said Arne Lohmann Rasmussen, chief analyst at A/S Global Risk Management. “Market sentiment is expected to remain highly nervous as we head into the weekend. We estimate that there is currently a risk premium of approximately $8 priced in.”

Article content

—With assistance from Yongchang Chin.

Article content

.jpg) 6 hours ago

1

6 hours ago

1

English (US)

English (US)