Article content

(Bloomberg) — A buildup of a billion barrels of oil on the world’s oceans includes a disproportionately large amount of crude from nations subject to some kind of sanctions — a sign the measures are bringing a degree of disruption to the oil trade.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

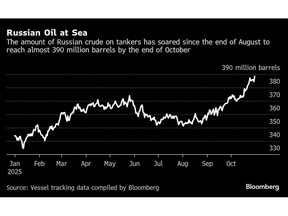

Of the surge in oil on tankers since the end of August, as much as roughly 40% of the increase is barrels from Russia, Iran, Venezuela, or unclear origin, according to vessel-tracking data from Vortexa, Kpler and OilX. Even the lowest estimate, at about 20%, is a larger share of global crude production than the three nations have.

Article content

Article content

Article content

The buildup doesn’t mean the barrels will never sell, but it is a threat to the revenues of sanctioned petrostates, with further ramifications for a global oil market that’s forecast to be headed for oversupply. While the increase partly reflects higher output, it also suggests some level of difficulty discharging. There’s also been a simultaneous surge in unsanctioned supplies.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The fate of all that crude on water, affected by sanctions or not, will go a long way to shaping how oil prices move over the next few months, traders said. Caution over the latest Western measures is triggering some reshuffling of crude flows, with ripple effects for major importers like India and China, while a stretched out tanker fleet briefly sent daily shipping costs above $100,000 a day.

Article content

“Some of this increase is attributed to stricter Western sanctions, which have left Russian oil stuck on ships and unable to discharge,” Clarksons Securities analysts including Frode Morkedal wrote. “Previous buyers have purchased replacements from the Middle East and the Atlantic.”

Article content

The buildup in restricted oil is led by Russian supplies, according to a Bloomberg analysis of the data from the vessel-tracking firms.

Article content

Article content

Russian seaborne shipments have risen in recent weeks, with the country pumping more oil as it unwinds earlier production cuts alongside partners in the OPEC+ group of oil producers. It’s likely that some crude is being diverted to export terminals as a result of Ukrainian attacks on Moscow’s oil infrastructure, particularly refineries.

Article content

An unprecedented Western clampdown on buyers of Russian barrels, meanwhile, is stopping some cargoes from discharging, with Indian refineries notably refraining from taking cargoes and signs that China might not be willing to pick up the slack. US sanctions on Russia’s two largest oil producers, Rosneft PJSC and Lukoil PJSC, have made trading their oil even more difficult.

Article content

Russia’s oil-related tax revenues fell year on year by more than 24% last month, according to Bloomberg calculations based on Finance Ministry data. Russia’s government already expects funds from oil and gas flowing into the budget this year to be the lowest since the pandemic of 2020.

Article content

Iranian shipments have also surged, hitting the highest level in seven years in October, the same month when the US placed sanctions on a major Chinese terminal for its role in buying barrels that help fund the Islamic regime.

.jpg) 2 hours ago

2

2 hours ago

2

English (US)

English (US)