Article content

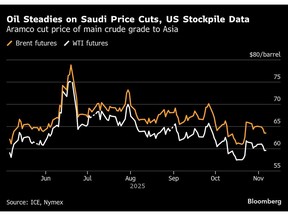

(Bloomberg) — Oil steadied after a two-day decline, as traders weighed price cuts from key producer Saudi Arabia and the biggest jump in US stockpiles since July.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Brent held above $63 after sliding 2.1% over the previous two sessions, while West Texas Intermediate was below $60. The cut by Saudi Aramco in the price of its main grade to Asia was in line with expectations. Meanwhile, the US Energy Information Administration said nationwide crude inventories rose 5.2 million barrels in the week ending Oct. 31.

Article content

Article content

Article content

Brent has slid almost 15% this year as increased production from OPEC+ and non-member nations amplifies concerns about a global glut, although US sanctions on Russia’s two biggest producers, along with Ukrainian strikes on its neighbor’s energy infrastructure, have raised some supply concerns. The boss of commodities trader Mercuria Energy Group Ltd. said at the Adipec conference in Abu Dhabi on Wednesday that the oversupply is forming slowly, but is likely to be as much as 2 million barrels a day next year.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“Downward pressure is expected to remain dominant in the current market as concerns over supply continue,” said Kim Kwangrae, a commodities analyst at Samsung Futures Inc. in Seoul. The Saudi price cut was in line with expectations and appears to be an effort to win market share, he said.

Article content

The EIA report also provided some backstop to the bearish momentum. US gasoline stockpiles dropped nearly 5 million barrels to the lowest in three years, even as exports and demand were nicerelatively flat.

Article content

Advertisement 1

.jpg) 2 hours ago

2

2 hours ago

2

English (US)

English (US)