Article content

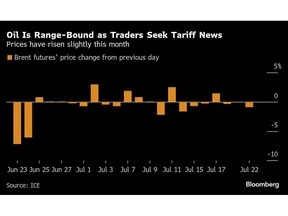

(Bloomberg) — Oil inched lower for a fourth day amid nascent signs of a softening physical market, while investors monitored progress on US tariff talks.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

West Texas Intermediate crude fell to trade below $65 a barrel after the US Energy Information Administration reported that inventory levels at Cushing, Oklahoma, the delivery point for WTI futures, rose to the highest since June. Distillate reserves increased for a second straight week. Still, overall crude inventories fell, and stockpiles of the fuel remain at the lowest level since 1996, lending support to oil markets.

Article content

Article content

Article content

“Cushing is perhaps the most important takeaway, with more builds expected in the weeks ahead to carry it away from historic lows,” said Matt Smith, Americas lead oil analyst at market intelligence firm Kpler.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The stockpile data provided a downside catalyst to prices that had been drifting aimlessly amid mixed trade developments. While President Donald Trump unveiled deals with Japan and the Philippines, the European Union plans to quickly hit the US with 30% tariffs on billions of dollars worth of goods if no agreement is reached.

Article content

US Treasury Secretary Scott Bessent said he’ll discuss a potential extension of the trade truce with China during talks in Stockholm next week. The discussions can now take on a broader array of topics, potentially including Beijing’s continued purchases of “sanctioned” oil from Russia and Iran, he said.

Article content

Crude has traded in a relatively narrow range this month after a volatile June, when prices were jolted by the conflict between Israel and Iran. US crude is still down about 10% this year on concerns Trump’s tariff war will stifle consumption as OPEC+ brings back production.

Article content

“We are racing towards the Aug. 1 deadline for reciprocal US tariffs,” said Harry Tchilinguirian, group head of research at Onyx Capital Group. “Japan deal done, now it is a question of if they pull a rapid deal out of the bag for the EU.”

Article content

—With assistance from Yongchang Chin.

Article content

.jpg) 12 hours ago

1

12 hours ago

1

English (US)

English (US)