Article content

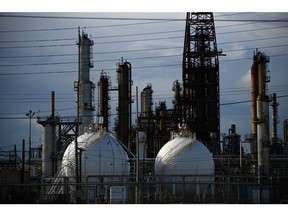

(Bloomberg) — Oil edged higher after a three-day drop as traders tracked US stockpiles and the latest twists in the Washington-led trade wars.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Brent rose toward $69 a barrel after shedding more than 2% over the previous three sessions, while West Texas Intermediate was near $67. US government data released on Wednesday was mixed, with an increase in distillate inventories but a decline in nationwide crude holdings.

Article content

Article content

Article content

President Donald Trump said he would send letters to more than 150 countries notifying them of tariff rates, and that the levies imposed could be 10% or 15%. Investors were also tracking his stance toward Federal Reserve Chair Jerome Powell after the US leader denied a plan to remove him.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Oil has ticked higher this month — building on an upward trend since May — despite concerns that Trump’s tariff onslaught will hurt demand. While the market remains preoccupied with the prospect of a glut later this year as peak summer demand wanes and OPEC+ returns halted supplies, nearer-term indicators, including in the diesel market, have been supportive.

Article content

“Near term, the market is grappling with relatively low inventories of crude and diesel in Europe and the US, with diesel shortages lending immediate strength to prices,” said Zhou Mi, an analyst at a research institute affiliated with Chaos Ternary Futures Co. Still, crude may return to a bearish trend once OPEC+ supply growth translates into a build-up in oil inventories, Zhou said.

Article content

In the US, distillate stockpiles remain at the lowest seasonal level since 1996 even after last week’s increase. At the same time, the spread in futures between low-sulfur gasoil and Brent for September— a gauge of the profitability of making diesel — has risen about 7% this month.

Article content

In the Middle East, several oil fields in the semi-autonomous Kurdistan region in northern Iraq were attacked by drones on Wednesday, adding to a spate of hits on energy installations in the area. Still, the region hasn’t been shipping any crude to global markets since an export pipeline was shut over two years ago.

Article content

Article content

Article content

.jpg) 7 hours ago

1

7 hours ago

1

English (US)

English (US)