Article content

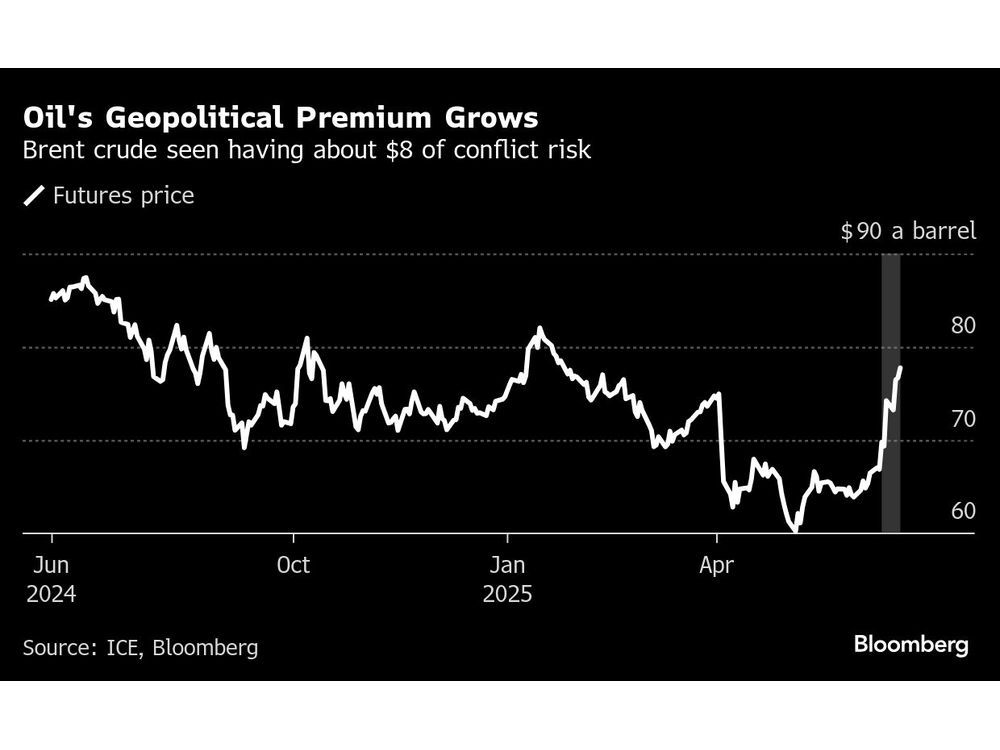

Oil watchers are re-evaluating the risk premium they should place on the global crude market, with the prospect of the U.S. joining Israel in bombing Iran looming.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Brent futures have been pricing in a geopolitical premium of about US$8 a barrel since Israel and Iran began attacking each other last week, according to a survey of analysts and traders. U.S. intervention in the conflict would bolster that further, but exactly how much would depend on the nature of the involvement, the nine respondents said.

Article content

Article content

Article content

Senior U.S. officials have been preparing for the possibility of a strike on Iran in the coming days, with some pointing to potential plans for a weekend strike. U.S. President Donald Trump has for days publicly mused about joining the attacks, a move that would escalate the conflict in a region that produces about a third of the world’s oil.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Traders are glued to developments around the vital Straight of Hormuz, through which a fifth of the world’s crude shipments pass, and on Iran’s critical oil infrastructure — all of which are so far flowing normally. Data Wednesday suggested Iran has actually increased exports since attacks began.

Article content

But further escalation could change that. Shell PLC chief executive officer Wael Sawan warned that a potential blockage of the key Persian Gulf chokepoint could deliver a substantial shock, and that the oil major has contingency plans for that.

Article content

“We think the worst case is far from priced in,” Barclays analyst Amarpreet Singh said. “In the worst case scenario of a wider conflagration, we would expect prices to move past US$100 a barrel.”

Article content

Article content

Article content

Options markets show how traders have begun to reflect that risk over recent days.

Article content

Read More

-

Oil price hike 'astronomical' if Iran's crude hit

-

Oil climbs after Trump talks down prospect of truce

Advertisement embed-more-topic

Article content

Call options have been commanding the biggest premiums over bearish puts since at least 2013 — eclipsing a spike in 2022 when there were fears that the war in Ukraine would disrupt output in Russia, another of the world’s largest producers.

Article content

Trading volumes for both futures and options have also soared to a record as investors try to hedge against the risk of prices surging further. Open interest data show a steady rise in strikes above US$90 a barrel since the start of last week.

Article content

Still, there have also been some additions of put options in the US$60s as traders hedge for the rally to fade, given the lack of disruption so far.

Article content

“One can easily position for a spike up in prices with U.S. intervention by buying out of the money calls,” said Harry Tchilinguirian, head of research at Onyx Capital Group.

Article content

Traders can also do the opposite if they believe a spike will be short-lived, by selling calls and buying puts, he added, noting that carries higher risk given the uncertainty of where prices could go.

Article content

Goldman Sachs Group Inc. said Thursday that it currently sees a risk premium of US$10 a barrel priced into the market and that high global spare capacity could buffer any price spike.

Article content

“The term structure of implied volatility and call skew suggest that oil markets believe that much higher prices are likely in the next few months, but see limited changes to the long-term outlook,” analysts including Daan Struyven wrote.

Article content

Article content

.jpg) 6 hours ago

1

6 hours ago

1

English (US)

English (US)