Article content

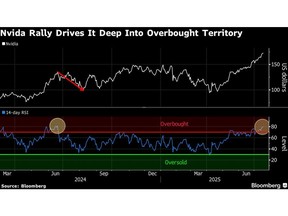

(Bloomberg) — Nvidia Corp. traders keep getting reasons to buy the stock, but the breakneck rally is showing signs of overheating.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The chipmaker’s 14-day relative strength index briefly topped 80 on Thursday, the highest since June 2024 when the stock dropped more than 20% over the following six weeks. The momentum gauge tracks the speed of a stock’s recent price changes and a reading over 70 is a signal to some analysts that buying is at extreme levels.

Article content

Article content

Article content

“It’s definitely getting overbought, and while that doesn’t mean a reversal is imminent, this is something to be mindful of,” said Jonathan Krinsky, chief market technician at BTIG. “It feels like sentiment, which had been optimistic, is getting borderline giddy.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Nvidia, which dominates the market for chips used in artificial intelligence computing, has staged a dramatic reversal since April when a broad tariff-induced selloff added to fears about a potential pullback in AI spending. Since then, the firm’s biggest customers have continued to plow more money into the development of AI services and investors have flocked back to the stock, pushing it up 83% in less than four months.

Article content

The latest leg of the rally has been driven by news that Nvidia plans to resume sales of some AI chips in China with the approval of the US government. The policy reversal from President Donald Trump’s administration could help recover a large chunk of the $15 billion in Nvidia’s fiscal 2026 data center revenue that had been at risk from US chip export restrictions, according to Bloomberg Intelligence analyst Kunjan Sobhani.

Article content

Article content

This week, Trump also touted more than $92 billion in commitments to invest in AI and energy infrastructure, while Meta Platforms Inc. CEO Mark Zuckerberg affirmed plans to spend “hundreds of billions of dollars” on data center investments. The Facebook parent is Nvidia’s second-largest customer, after Microsoft Corp., according to supply chain data compiled by Bloomberg.

Article content

Nvidia is on track for its eighth-straight week of gains and the rally from its April low has added roughly $1.9 trillion to its market value, a figure that alone exceeds the market capitalization of Meta. At more than $4.2 trillion, Nvidia is again the world’s most valuable company, topping second-ranked Microsoft by about $400 billion.

Article content

“Clearly, momentum is behind it,” said James Abate, managing director and head of fundamental strategies at Horizon Investments. “It seems like every time we get incremental good news, buyers rush in and we get another leg up in the stock.”

Article content

Still, Abate has used the advance to sell some Nvidia shares. In addition to the rising valuation, he said he’s concerned that investors are underestimating the potential for “the future cyclicality of the AI business.”

.jpg) 4 hours ago

1

4 hours ago

1

English (US)

English (US)