Article content

(Bloomberg) — Norway’s $2.1 trillion sovereign wealth fund has reinforced its energy team as it looks to expand its portfolio of renewable assets in Europe and into North America.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The world’s biggest sovereign investor hired three people in New York over the summer, bolstering the size of the team overseeing its energy portfolio to about 20, according to Harald von Heyden, global head of energy and infrastructure. The fund sees a brightening market for closely held renewable wind, solar and power-grid projects even as the sector faces political turmoil.

Article content

Article content

Article content

“We have to find good deals, first and foremost, but we are optimistic,” von Heyden said in an interview in Oslo. “This year and last, you’re seeing gigantic projects becoming a reality, not just on the drawing board.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

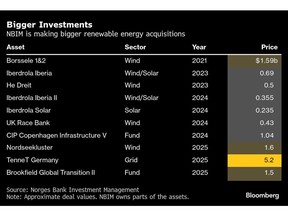

Norges Bank Investment Management, as it is known officially, made its first renewables foray in 2021, with a stake in a Dutch offshore wind farm alongside Danish wind developer Orsted A/S. While it took almost a year and a half for a follow-up deal to materialize — a €600 million ($690 million) agreement to buy a 49% share in an array of Spanish onshore wind and solar plants — the pace of investments and the size of purchases have jumped in recent months.

Article content

While the bulk of NBIM’s renewable infrastructure investments to date are in Europe, the US is “on the doorstep,” von Heyden said, and the team is “actively looking” for deals. When asked about whether the Trump administration’s war on renewables is weighing on sentiment, he said, “you have political risk everywhere, you just have to be smart.”

Article content

Von Heyden, formerly head of energy and infrastructure at Arctic Securities, last year oversaw the merger of the two teams managing the fund’s unlisted and listed energy portfolios worth close to $50 billion. This includes everything from physical solar arrays and wind parks to shareholdings in oil giant Exxon Mobil Corp and wind turbine maker Vestas Wind Systems A/S.

Article content

Article content

In its largest deal to date, NBIM was part of a consortium that in September bought 46% of Tennet Holding BV’s German power grid, valued at €9.5 billion. The Norwegian investor agreed to invest almost half the sum.

Article content

It was an opportunity that “comes once or twice in a career, if you’re lucky,” the executive said, adding that it was a “double-first,” marking NBIM’s entry into power networks and also into owning a stake in a company with thousands of employees.

Article content

The fund remains interested in adding more power grids to its portfolio, as well as battery storage, he said, though its requirements for the reputation, experience and creditworthiness of its partners “filters out a lot.” As does NBIM’s minimum ticket size of roughly €500 million, he said.

Article content

The fund’s portfolio of unlisted renewable infrastructure now includes 12 investments, worth about $14 billion. This is still a fraction of the approximately $40 billion available to NBIM, with its mandate allowing up to 2% of the fund’s value to be invested in the space either in Europe or in North America. It can invest up to 15% of this sum indirectly into renewable energy funds, such as Brookfield Asset Management’s Global Transition Fund II.

Article content

—With assistance from Heidi Taksdal Skjeseth.

Article content

.jpg) 2 hours ago

1

2 hours ago

1

English (US)

English (US)