Article content

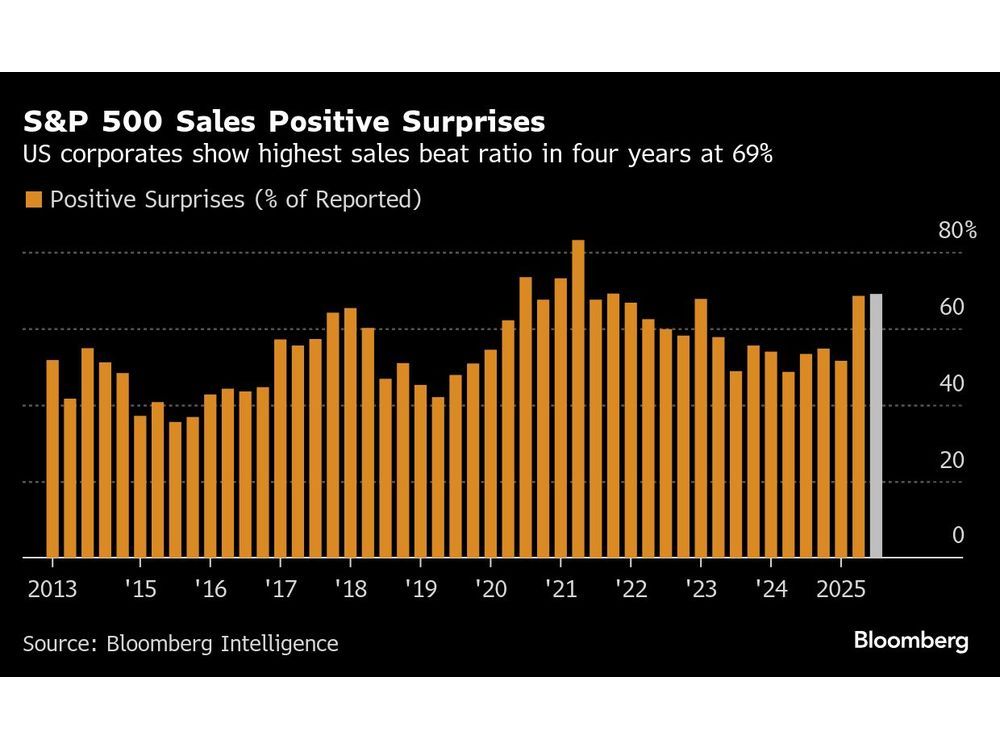

The S&P 500 is on course to have the most companies delivering sales beats in about four years this earnings season, with Corporate America seeming to cope just fine with the impact of tariffs.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Almost 70 per cent of index members to have reported so far have exceeded third-quarter sales estimates, according to a Bloomberg Intelligence earnings tracker. That’s the highest proportion of positive surprises since the post-COVID-19 revival in the final three months of 2021.

Article content

Article content

Article content

American companies appear to be fairly unscathed by tariffs so far, protecting their margins through a combination of price increases and cost cuts. Meanwhile, the magnitude of the sales beats is also near the highest since the post-pandemic boom: companies have exceeded estimates by 2.4 per cent in aggregate, against a historical average of 0.5 per cent, according to strategists at Deutsche Bank AG.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“Sales beats have correlated well with inflation surprises historically and likely partly reflect the impacts of tariffs on pricing this time,” Deutsche Bank’s Bankim Chadha and Parag Thatte wrote in a note.

Article content

Article content

Meanwhile, with readings on the United States economy and job market still holding up, and further interest rate cuts from the United States Federal Reserve on the way, the profit outlook is looking increasingly brighter for 2026.

Article content

“It’s early in earnings season, but this could be an initial indication that top line growth is firming into next year, in line with our view,” wrote Morgan Stanley strategists led by Michael Wilson. His team sees revenue beats running at double the historical rate as the “standout” feature of this earnings season.

Article content

Article content

The view among most Wall Street strategists is that the strongest earnings and sales growth remains concentrated in megacap and technology stocks. But other sectors are delivering decent profit increases, helped by favourable comparables. Financials, real estate, materials and utilities are all showing double-digit earnings gains so far, according to Deutsche Bank strategists.

Article content

Read More

Article content

Even so, the flurry of beats isn’t keeping everyone bullish. The current positive trend may not be easy to sustain, according to RBC Capital Markets strategist Lori Calvasina.

Article content

“We think earnings are providing a solid foundation for the U.S. equity market, but that it will be difficult to replicate the same kind of surge in earnings optimism that helped power markets higher in the last reporting season,” Calvasina said.

Article content

There’s still a long way to go this season, with companies accounting for 50 per cent of the S&P 500 market capitalization due to report this week, including most of the large artificial intelligence hyperscalers such as Microsoft Corp. Alphabet Inc. and Meta Platforms Inc.

.jpg) 3 hours ago

1

3 hours ago

1

English (US)

English (US)