Article content

Caigen Wang, Managing Director of Aurum, commented: “We are delighted to obtain the endorsement of Montage, along with the strategic investments from the Lundin Family and Zhaojin, as it is a true endorsement of the quality of our two gold projects in Côte d’Ivoire. Moreover, we look forward to collaborating with Montage to drive mutual value creation given our proximity to the Koné project and the track record of both management teams. On completion of this placement, we will have liquidity sources in excess of A$45 million which will enable Aurum to accelerate growth of gold resources at both Boundiali and Napié. These funds will be sufficient to complete the Boundiali pre-feasibility study, ESIA study and approval, mining exploitation licence application and approval as well as the definitive feasibility study, all prior to H2-2026.”

Article content

Key terms of the investment

Montage has entered into binding documentation with respect to a transaction (the “Share Exchange Transaction”) with the following key terms:

Article content

- Equity Swap: Montage will obtain a 9.9% ownership in Aurum, through the Share Exchange Transaction, which will result in the issuance of 32,887,521 Aurum ordinary shares to Montage, and the issuance of up to 2,887,496 common shares of Montage (“Montage Shares”) to Aurum equating to an 0.8% ownership in Montage, for a total implied transaction consideration of C$10.4 million. The Share Exchange Transaction is based on a Montage share price of C$3.61 and an Aurum share price of A$0.356, each representing the 5-day VWAP as at May 2, 2025. Montage Shares will be issued to Aurum under an exemption from the prospectus requirements of applicable Canadian securities laws and will be subject to a hold period of four months and one day. Any Aurum sale of Montage shares will be subject to certain notice rights to enable Montage Gold to designate a suitable purchaser(s).

- Timing and Approvals: The Share Exchange Transaction and the Offering are subject to the approval of Aurum shareholders at an Extraordinary General Meeting scheduled for mid-June 2025, and the issuance of the Montage Shares is subject to the approval of the TSX, and is otherwise expected to close in late June 2025.

Article content

Article content

Aurum will use the proceeds of the Offering to accelerate resource definition drilling at the Boundiali gold project and exploration drilling at its Napié gold project, in Côte d’Ivoire, including the purchase of an additional two diamond drill rigs. The proceeds will also be used to progress technical studies and permit applications.

Article content

ABOUT AURUM RESOURCES

Aurum owns the Boundiali and Napié gold projects in Côte d’Ivoire, as summarized below.

Article content

Boundiali Gold Project

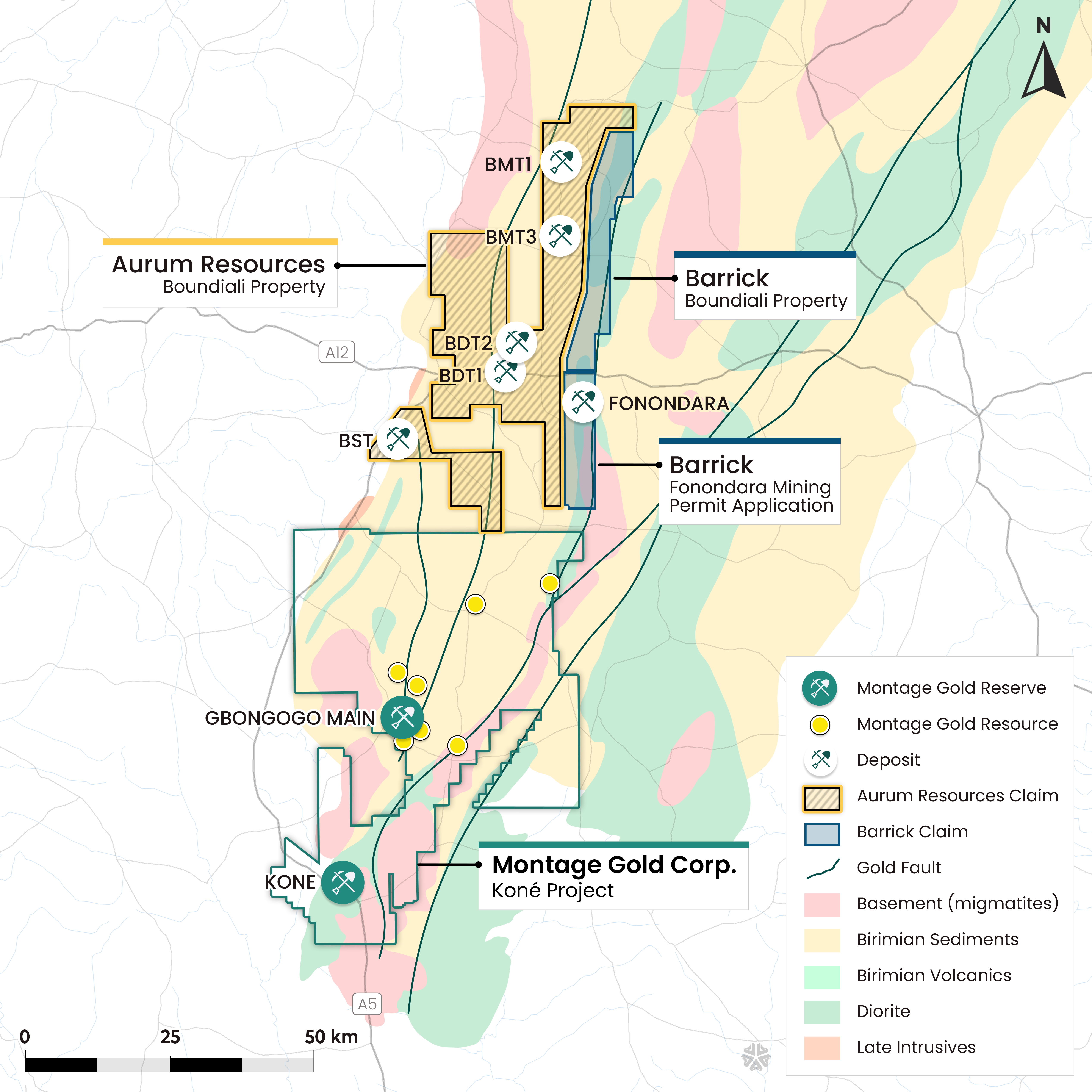

As shown in Figure 1 below, Aurum owns the Boundiali gold project in northern Côte d’Ivoire, a 1,037km2 exploration property located along the same greenstone belt as Montage’s Koné project. The Boundiali gold project demonstrates many geological similarities to the Koné project and covers a largely underexplored southern extension of the belt where a highly deformed synclinal greenstone horizon traverses finer grained basin sediments, with sporadic emplacements of granitic bodies along the margins of the belt.

Article content

In December 2024, Aurum announced a JORC-compliant mineral resource estimate (the “Boundiali MRE”) of 1.59Moz at 1.0g/t Au derived from the BST (Nyangboue), BD Target 1 and 2, and BM Target 1 and 3 deposits.

Article content

Article content

A 100,000-meter drill programme is currently underway at the Boundiali gold project, with a particular focus on the higher grade Nyangboue gold deposit, which is the target located closest to Montage’s exploration grounds. Aurum expects to publish an updated resource estimate and a Preliminary Feasibility Study (“PFS”) by year-end.

Article content

Figure 1: Location of the Boundiali gold project

Article content

Article content

Article content

Article content

Napié Gold Project

Aurum owns the Napié gold project in north central Côte d’Ivoire. The Napié gold project is located 30km southeast of the city of Korhogo and covers a strike length of 30km. The Napié gold project straddles a land package of 224km2 and is considered prospective for gold.

Article content

In June 2022, the Napié gold project had a JORC-2012-compliant mineral resource estimate of 868koz at 1.20g/t Au, based on the Tchaga and Gogbala deposits, two of four prospects located on the 30km-long Napié Shear. Only 13% of the Napié Shear has been tested to date.

Article content

Aurum is planning 30,000 meters of drilling at Napié in 2025 to expand the current mineral resource estimate.

Article content

ABOUT MONTAGE GOLD

Montage Gold Corp. (TSX: MAU) is a Canadian-listed company focused on becoming a premier African gold producer, with its flagship Koné project, located in Côte d’Ivoire, at the forefront. Based on the Updated Feasibility Study published in 2024 (the “UFS”), the Koné project has an estimated 16-year mine life and sizeable annual production of +300koz of gold over the first 8 years and is expected to enter production in Q2-2027.

.jpg) 15 hours ago

1

15 hours ago

1

English (US)

English (US)