Article content

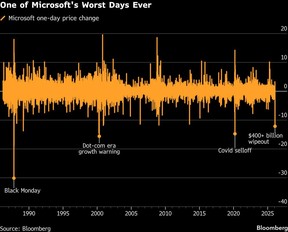

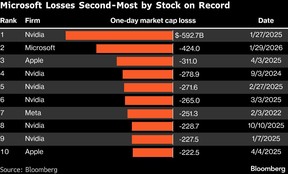

Microsoft Corp. is on track for the record books Thursday, as its more than US$400 billion wipeout in stock market valuation would be the second-largest in history if it holds through the close.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Shares of the software giant were down 12 per cent as of 1:20 p.m., their biggest intraday plunge since March 2020, erasing roughly US$424 billion in market value. The decline was triggered by Microsoft’s earnings after the bell Wednesday, which showed record spending on artificial intelligence as growth at its key cloud unit slowed.

Article content

Article content

Article content

Article content

The only larger one-day valuation destruction in stock market history was Nvidia Corp.’s US$593 billion rout last year after the launch of DeepSeek’s low-cost AI model. Microsoft’s move is larger than the market capitalizations of about 96 per cent of S&P 500 Index members and bigger than the values of stock markets in countries such as Finland, Vietnam and Poland, according to data compiled by Bloomberg

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The chill is being felt elsewhere as well, with peers including Alphabet Inc. and Nvidia each shedding more than US$100 billion at one point on Thursday.

Article content

The selloff comes amid heightened skepticism from investors that the hundreds of billions of dollars Big Tech is spending on AI will eventually pay off. Microsoft’s results showed a 66 per cent rise in capital expenditures in its most recent quarter to a record US$37.5 billion, while growth at its closely tracked Azure cloud-computing unit slowed from the prior quarter.

Article content

Article content

“Since it is becoming even more evident that Microsoft is not going to garner a strong ROI from their massive AI investment, their shares need to be revalued back down to a level that is more consistent with its historic fair value,” said Matthew Maley, chief market strategist at Miller Tabak + Co.

Article content

The roughly 12 per cent drop in Microsoft’s share price is among the worst in its history. Since it’s initial public offering in 1986, the stock has only seen a handful of days with bigger declines, including on Black Monday in 1987, during the dot-com bubble, and at the height of the COVID 19 fuelled selloff in 2020.

Article content

Article content

We apologize, but this video has failed to load.

Article content

.jpg) 1 hour ago

3

1 hour ago

3

English (US)

English (US)