Article content

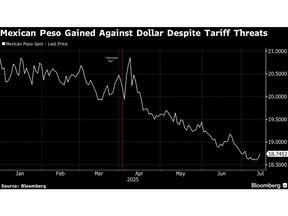

(Bloomberg) — Betting on Mexico’s currency has paid off for investors even amid Donald Trump’s trade war.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The peso is up 11% this year, beating all regional peers, even as it dipped Monday following the latest tariff news — a threat of a 30% levy announced over the weekend. It is also one of the best performing in emerging markets.

Article content

Article content

Mexico’s high interest rates and President Claudia Sheinbaum’s tempered approach toward Trump have helped lure in cash from investors reallocating money away from the US. And after months of repeated delays on the implementation of tariffs, money managers have grown more complacent, with reactions to fresh announcements largely contained as they look past Trump’s threats to focus on the medium-term outlook.

Article content

Article content

“Markets know the drill,” said Marco Oviedo, a senior strategist at XP Investimentos in Sao Paulo. “The only risk that I see is if the Mexican government fails to deliver something that Trump wants on drug control that might leave tariffs high for longer or negotiations in limbo.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Mexico’s strong economic ties to the US have also worked in the peso’s favor. The US doesn’t intend to apply the 30% rate to USMCA-compliant goods, a White House official said on Saturday. The administration has previously said it will keep the exemption for Canada.

Article content

Although Mexican officials were taken aback by Trump’s latest tariff threat, US Ambassador to Mexico Ronald Johnson said Saturday in Mexico City that Sheinbaum and Trump have a “wonderful relationship” and no partnership should be easier than between their two countries.

Article content

Sheinbaum said Monday during her daily press conference that her government expects to reach a tariff deal with the US before an Aug. 1 deadline and has a plan if talks fail. She’s expected to meet later today with a Mexican trade negotiating team that was in Washington on Friday discussing the issue.

Article content

Article content

The country’s rate differentials are another factor helping prop up the currency. The central bank has been cautious when lowering interest rates, keeping the peso on the radar of carry traders who borrow in lower-yielding currencies to buy those that offer higher yields.

Article content

After delivering a half-point cut that left the key rate at 8% last month, Governor Victoria Rodriguez embraced the likelihood of smaller reductions going forward in a July 9 speech. That helped the peso inch higher last week, outperforming as developing-world currencies slipped amid the latest barrage of tariff announcements.

Article content

The rally in Mexico has gone beyond the currency. Local bonds and stocks have also gained in the wake of Trump’s so-called Liberation Day on April 2 amid a positive backdrop for emerging markets as the dollar slips.

Article content

“The peso is trading incredibly well in the face of this,” said Eric Fine, portfolio manager for emerging markets debt at Van Eck Associates. “This reaction has many explanations, but EMFX and interest rates have had a great year despite tariff-dominated news flow.”

Article content

(Updates with additional details on USMCA, Sheinbaum comments and asset moves starting in fifth paragraph)

Article content

.jpg) 6 hours ago

1

6 hours ago

1

English (US)

English (US)