Article content

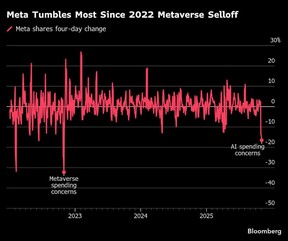

The huge checks Meta Platforms Inc. is writing to support its artificial intelligence ambitions are reminding some investors of the massive Metaverse outlays that crippled the stock just a few years ago.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Facebook’s parent posted results last week that beat expectations on key metrics. But Wall Street’s focus was on capital expenditures, which the company said would be as much as US$72 billion this year and “notably larger” in 2026. Then, on the earnings call, chief executive Mark Zuckerberg downplayed concerns that Meta might be over-spending on things like its Superintelligence Labs group, saying “it’s the right strategy to aggressively front-load building capacity.”

Article content

Article content

Article content

Now Meta shares just posted their worst four-day run since November 2022, falling almost 17 per cent and wiping out US$307 billion in market value. Not coincidentally, the 2022 selloff was also triggered by investors questioning its spending plans, ultimately sending the stock down 77 per cent from a 2021 peak.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“This feels like a return to Meta’s old days of overspending on things that are frivolous or which don’t have appropriate return demands tied to them,” said Tiffany Wade, senior portfolio manager at Columbia Threadneedle Investments, which has about US$714 billion in assets. “Investors are losing patience.”

Article content

The stock rose 0.2 per cent on Wednesday.

Article content

Article content

Of course, even with the latest tumble, Meta’s stock remains up 7.5 per cent this year. That’s because until very recently, spending large sums on AI wasn’t seen as a negative. In fact, companies were rewarded for it because it showed they were staying competitive in the evolving tech landscape.

Article content

Zuckerberg has long touted how AI is leading to improved ad targeting and engagement. But with spending continuing to rise, investors are getting skittish about the outlays without more concrete signs of the payoffs.

Article content

Article content

Meta didn’t respond to a request for comment.

Article content

Article content

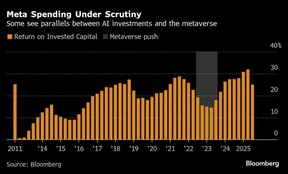

While AI is less of a long-shot than the Metaverse was, “you can draw some parallels between the spending on Superintelligence and Reality Labs,” Wade said. “Both are long-dated projects that don’t have an immediate payback and where the ultimate return is unclear.”

Article content

Wade isn’t the only Wall Street pro who sees the connection. Jason Helfstein, an analyst at Oppenheimer, downgraded Meta’s stock in the wake of the earnings report, writing that the “significant investment in Superintelligence despite unknown revenue opportunity mirrors 2021/2022 Metaverse spending.”

Article content

Meta isn’t the only example of investors getting cold feet about AI spending. Microsoft Corp. also fell on its results, although the drop was milder as investors see a clearer path from spending to growth in its Azure cloud-computing business. Unlike Microsoft — to say nothing of Amazon.com Inc. or Alphabet Inc., which rallied on their results — Meta is missing an enterprise-focused business like Azure that could benefit from AI’s proliferation.

Article content

Article content

“There’s a real lack of diversification in the business model,” said Stefan Slowinski, global head of software research at BNP Paribas, who was the only analyst with the equivalent of a sell rating on the stock in the days going into the results. “It has failed to expand into any real enterprise business, and we have the strategic error of the Metaverse.”

.jpg) 2 hours ago

2

2 hours ago

2

English (US)

English (US)