Article content

(Bloomberg) — Barclays Plc says that it’s about time to pump the brakes on a meme stock craze that’s driven sharp rallies in companies like Kohl’s Corp. and Opendoor Technologies Inc.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Retail traders have been piling into these unlikely names and sending their shares soaring, showing a kind of fervor that harkens back to the mania around GameStop Corp. shares during the Covid-19 pandemic.

Article content

Article content

Article content

But these stocks can fall as suddenly as they rise, which is why Stefano Pascale at Barclays says one potential tactic is a popular hedge-fund strategy known as the dispersion trade. It involves a combination of options in single stocks and contracts on a broad index like the S&P 500 Index.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

In this case, investors could use options to bet that a basket of meme stocks will continue to be far more volatile than the S&P 500. For traders wanting to take a more directional bet on the frothiest companies, they can buy puts that would benefit if these shares reverse course.

Article content

“There are certain corners of the market where it does feel very bubbly,” said Pascale, head of US equity derivatives strategy at Barclays.

Article content

He and his colleague Anshul Gupta have been warning about untethered market exuberance since the start of July. They point to a rush of companies going public by merging with blank-check companies, as well as the rally in Cathie Wood’s ARK Innovation ETF. The fund is bullish on a swath of tech stocks and is up 73% in the last three months.

Article content

These are “signs that we typically associate with a frothy market,” they wrote in July 1 note.

Article content

Article content

Social media buzz has spurred an outsized rally in retailer Kohl’s, which rose as much as 105% on Tuesday. Shares of Opendoor, a platform for buying and selling real estate, are up more than 440% since the start of the month.

Article content

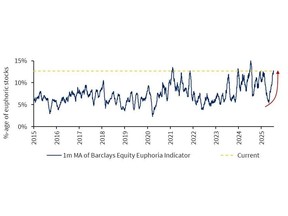

Mounting Euphoria

Article content

Last week, the Barclays Equity Euphoria Indicator, which uses options data to quantify investors’ giddiness, jumped to its highest level since late December.

Article content

“A lot of people may recognize that there is a bubble and they may recognize that in the end, they will have to unwind in some form or another,” Pascale said.

Article content

The challenge facing traders is how to pick the losers.

Article content

In a Monday note, Piper Sandler Cos. identified two stocks up significantly this year that could be dispersion-trade candidates. It’s bearish on beverage maker Celsius Holdings Inc., which is up 68% in 2025 and trades at a lofty price-to-earnings ratio of 77.6. Another is NRG Energy Inc., up 71% this year.

Article content

“To me, the activity is starting to have much more of a 2021 feel to it,” said Interactive Brokers’ chief strategist Steve Sosnick, referring to the peak of the GameStop frenzy.

.jpg) 7 hours ago

1

7 hours ago

1

English (US)

English (US)